Nvidia Records Revenue Surge in Recent Quarter and Issues Optimistic Sales Forecast, Suggesting that the AI Boom Elevating the Chipmaker to a 2 Trillion Dollar Valuation Continues to be Strong.

The revenue increased in the quarter to 26 billion dollars, a record value for the company. The net income amounted to 14.88 billion dollars, compared to 2 billion dollars in the previous year.

Both Revenue and Profit Exceeded Wall Street Estimates, According to a FactSet Survey. The Company's Outlook of About 28 Billion Dollars in Revenue for the Current Quarter Also Surpassed Expectations, Although Growth Now Faces a Stronger Comparison with Quarters Following the Onset of the AI Boom.

The Nvidia stock rose 4.4% after-hours to a record high. The company's shares have more than tripled over the past 12 months, lifting the valuation over 2 trillion dollars. The company announced a 10:1 stock split, to take effect from June 7th. Additionally, it increased its dividend from 4 to 10 cents.

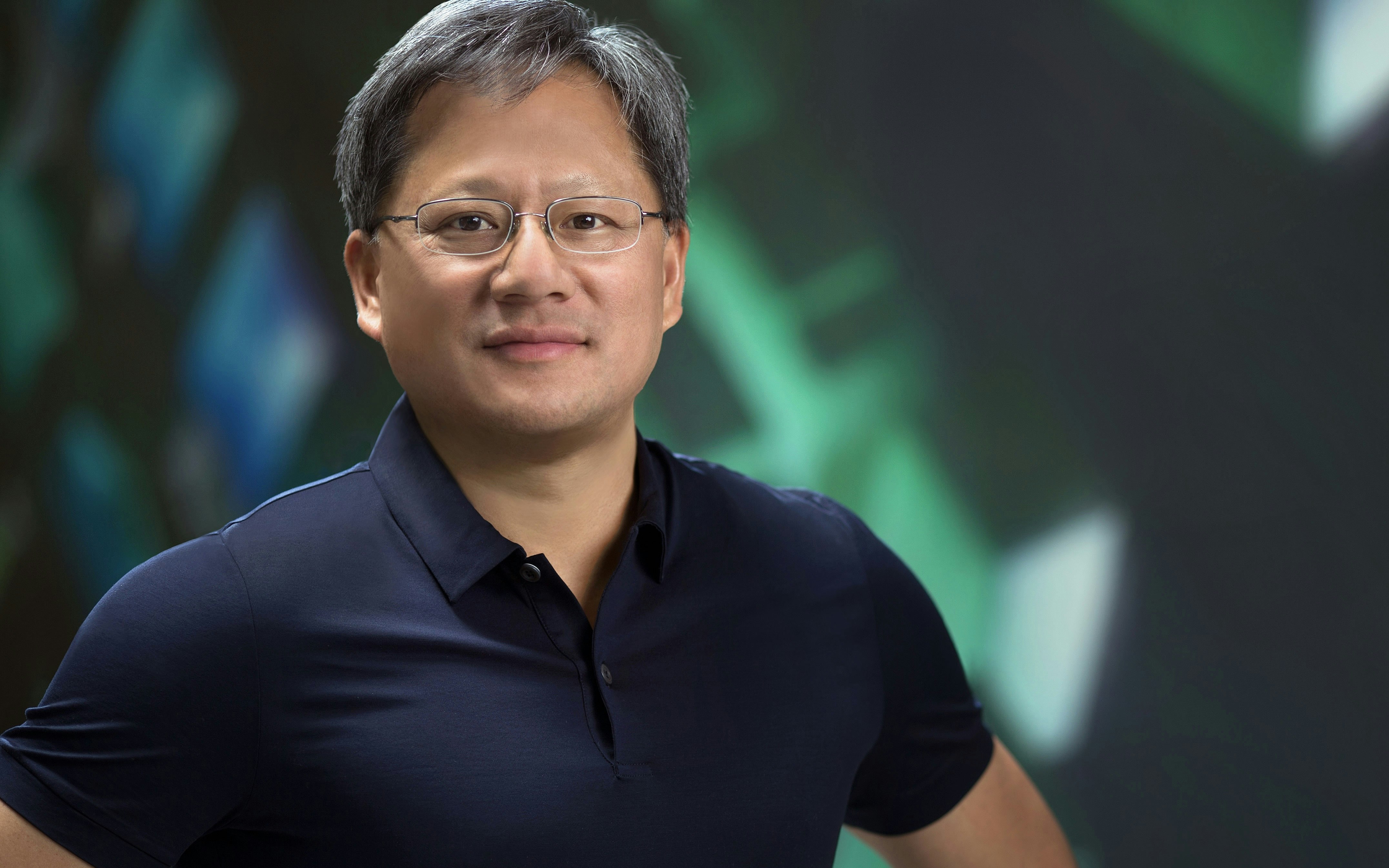

Nvidia CEO Jensen Huang Declares the Start of a New Industrial Revolution, with Nvidia Assisting in Converting $1 Trillion Worth of Data Centers into "AI Factories".

"AI will bring significant productivity gains to nearly every industry and help companies work more cost-effectively and energy-efficiently," said Huang in a statement.

Nvidia's Revenue Soared About a Year Ago After OpenAI's ChatGPT Impressed Users with Its Ability to Generate Human-Like Texts. OpenAI Utilized Thousands of Nvidia's AI Chips to Create ChatGPT, and There Are Few Alternatives for the Computing-Intensive Task of Developing and Deploying Such Systems.

Following the Resounding Success of OpenAI, Major Technology Companies and AI Startups Rush to Buy as Many Nvidia Chips as Possible, Leading to a Shortage That, According to Company Management, Could Last Into Next Year.

Despite the Sharp Increase in Nvidia's Profits, Revenue Growth Slows Down in Recent Quarters as the Company's Baseline Revenue Rises. Revenue Nearly Doubled from About $7.2 Billion in the First Fiscal Quarter a Year Ago to $13.5 Billion in the Second. It Then Increased to Over $18 Billion in the Third and Over $22 Billion in the Fourth Quarter.

The Recent Quarter Represented Another Slowdown in Growth, Although Morgan Stanley Analysts Noted in a Memo This Week That the Expected Slowdown Is Not an Issue for the Company’s Stock, as Its Valuation is in Line with Revenues Compared to Many of Its Major Corporate Peers.

Nvidia's CFO Colette Kress explained on Wednesday that major cloud computing companies such as Alphabet's Google, Microsoft, and Amazon.com account for about 45% of the company's data center revenue - more than 10 billion dollars.

Under the leadership of Huang, the company started more than three decades ago with the mission to improve computer graphics for gamers. In the last one and a half decades, it has repurposed its graphics chips for other applications, including AI, where the company's approach to performing many calculations simultaneously was a good fit.

The AI Boom Made Nvidia's Chips a Hotly Contested Commodity, with Tech CEOs Jostling Over Who Has More. Determined to Stay on Top, Nvidia Plans to Launch a New Generation of AI Chips by the End of the Year, Following Their Reveal at a Company Conference in March, Which Some Dubbed "AI Woodstock."

These Chips, Codenamed Blackwell, Are Expected to Cost More Than $30,000 Each, Setting the Stage for Another Revenue Increase if Demand for AI Chips Remains Strong and Nvidia Can Fend Off Challenges from Competitors and Regulators.

In preparation for the launch of Blackwell, the time it takes to acquire an H100 AI chip – the most advanced currently available from Nvidia – has been reduced from nearly a year to just a few weeks, analysts say, partly due to Nvidia's efforts to secure more supplies. Nvidia does not manufacture its own chips, but mostly outsources their production to Taiwan Semiconductor Manufacturing Co.

Highlighting the continued strong demand for the company's AI chips, Tesla, Meta Platforms, and other technology companies have said this year that they plan to buy thousands of them to support their AI efforts. Meta expects to have about 350,000 H100s by the end of this year, CEO Mark Zuckerberg said in January.