Hong Kong Stocks

Hong Kong's growth is driven by China's rise as the world's export champion. Eulerpool has compiled a list of stocks from Hong Kong for you.

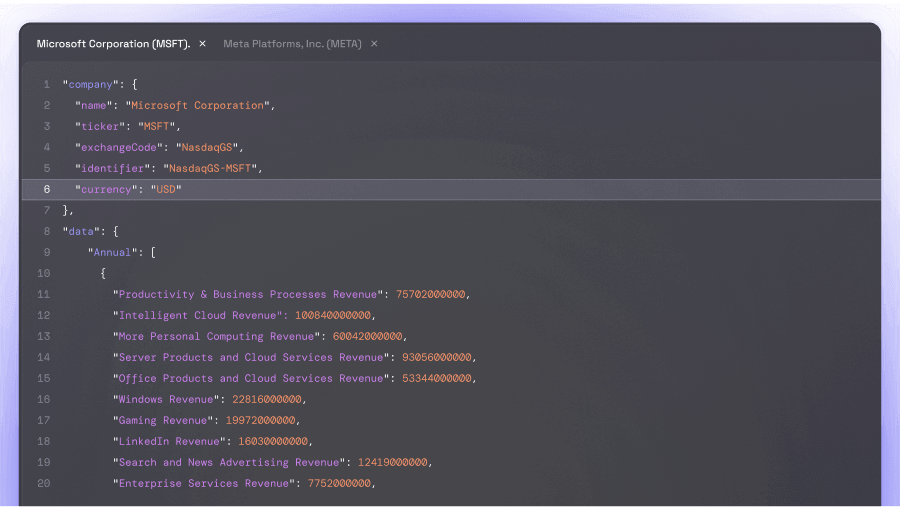

The Modern Financial Terminal

Trusted by leading companies and financial institutions

Top Stocks in Hong Kong

History and Politics

weltweit führenden Finanzzentren und bietet eine Vielzahl von attraktiven Investmentmöglichkeiten. Bei Eulerpool haben wir Zugang zu umfangreichen Daten über Hongkong-Aktien und können Ihnen fundierte Analysen und Statistiken liefern. Entdecken Sie alle Aktien aus Hongkong und nutzen Sie unseren Service, um den Fair Value dieser Unternehmen zu ermitteln. Melden Sie sich noch heute bei uns an und starten Sie Ihre erfolgreiche Investmentreise in Hongkong. four Asian Tiger economies (including Taiwan, South Korea, and Singapore). The four Asian tiger economies are the four countries that have experienced phenomenal growth since 1970, transforming from the poorest regions in the world to the wealthiest. But let's go back to the beginning first:

Hong Kong is a former Chinese colony that was occupied by the British. China has leased the land to Great Britain for 99 years. China has not forgotten this and they wanted their piece of land back. The population of Hong Kong was surveyed and they decided against it. They want to be their own country. Chinese people need a special visa and a valid reason (application takes several weeks) if they want to "enter" Hong Kong for just one day.

China continues to firmly assert that Hong Kong is a part of China. The Chinese population is also strongly convinced that Hong Kong is a province of China. This is how it's portrayed in the media. Thus, China still claims Hong Kong as "part of its own country." However, the Hong Kong government maintains that it is its own country, which aligns more with reality: there are separate tax systems, laws, and legal frameworks. These differing, often dramatic statements can occasionally lead to conflicts and political debates.

Economy and the trade dispute

Hong Kong's growth is driven by China's rise to become the world's leading exporter. It is one of the largest ports and trading hubs for China and Southeast Asia. Goods were initially shipped exclusively through Hong Kong. Hong Kong is known as the "Gateway to the West" or "Gateway to the East." It serves as a central hub connecting China with America/Europe. Up until the year 2000, 50% of all China exports were shipped through the port of Hong Kong.

China has recognized this consolidation of power and has since expanded its own ports, causing Hong Kong to lose significance and power. Since 2019, "only" about 10% of all exports from China have been sent via Hong Kong. Hong Kong is the best and often the only way to invest capital from outside into China, as well as to withdraw capital from China. Both are not easily possible, even for Chinese individuals.

The government has therefore passed a law: Every Chinese citizen may only take a maximum of 50,000 USD out of the country per year. Educated Chinese know that all companies and real estate belong to the state. All possessions are merely "borrowed".

Banks in Hong Kong, which assist the Chinese in transferring their money out of the country, earn excellent margins here, which they can determine themselves. A certain monopoly and pricing power can be observed. The stock market in Hong Kong is highly dependent on China, with prices having a high correlation with China's economic health.

Many companies headquartered in China are still listed in Hong Kong to provide investors with exactly this security, even though they do not generate any revenue in Hong Kong. The stock market in Hong Kong is considered to be very tightly controlled and regulated, which in my opinion is very necessary for Chinese companies.

The largest companies based in Hong Kong

One of the most well-known companies is the conglomerate Jardine Matheson with a market capitalization of approximately over 21 billion euros, the company Hutchison Whampoa, and China Mobile Group Limited (HK).

The largest and most important trading venues

The HKSE (Hong Kong Stock Exchange) is the fastest-growing stock exchange in the world by far.

Public companies in Hong Kong are subject to similar strict regulations as in America and Germany, and fraud or counterfeiting is extremely rare. All companies are annually audited by both the government and independent, globally recognized auditors.

Tencent, China Mobile, Ping An, and many Chinese banks are listed here. Unlike many exchanges such as in Shanghai and Shenzhen, the Hong Kong Stock Exchange is also accessible to foreign investors.

Taxes for German shareholders

Unlike in France, it is different for companies based in Hong Kong. They do not have any withholding tax. There are also some Chinese companies that operate through a headquarters in Bermuda or the Cayman Islands. These companies can be identified by their ISIN, which starts with either "BM" or "KY". The withholding tax for these companies is also 0%.

Index performance

Hang Seng Index The 50 most valuable stocks listed on the Hong Kong Stock Exchange (HKEX). Weighted by market capitalization. The top five stocks in the Hang Seng Index are the well-known Tencent, Alibaba, Ping An, Bank of China, and the AIA Group.

Opening hours in Hong Kong

Most Asian countries have different trading hours for stock exchanges compared to New York. In Hong Kong, the HKSE opens from 2:30 am to 9:00 am, based on European time.