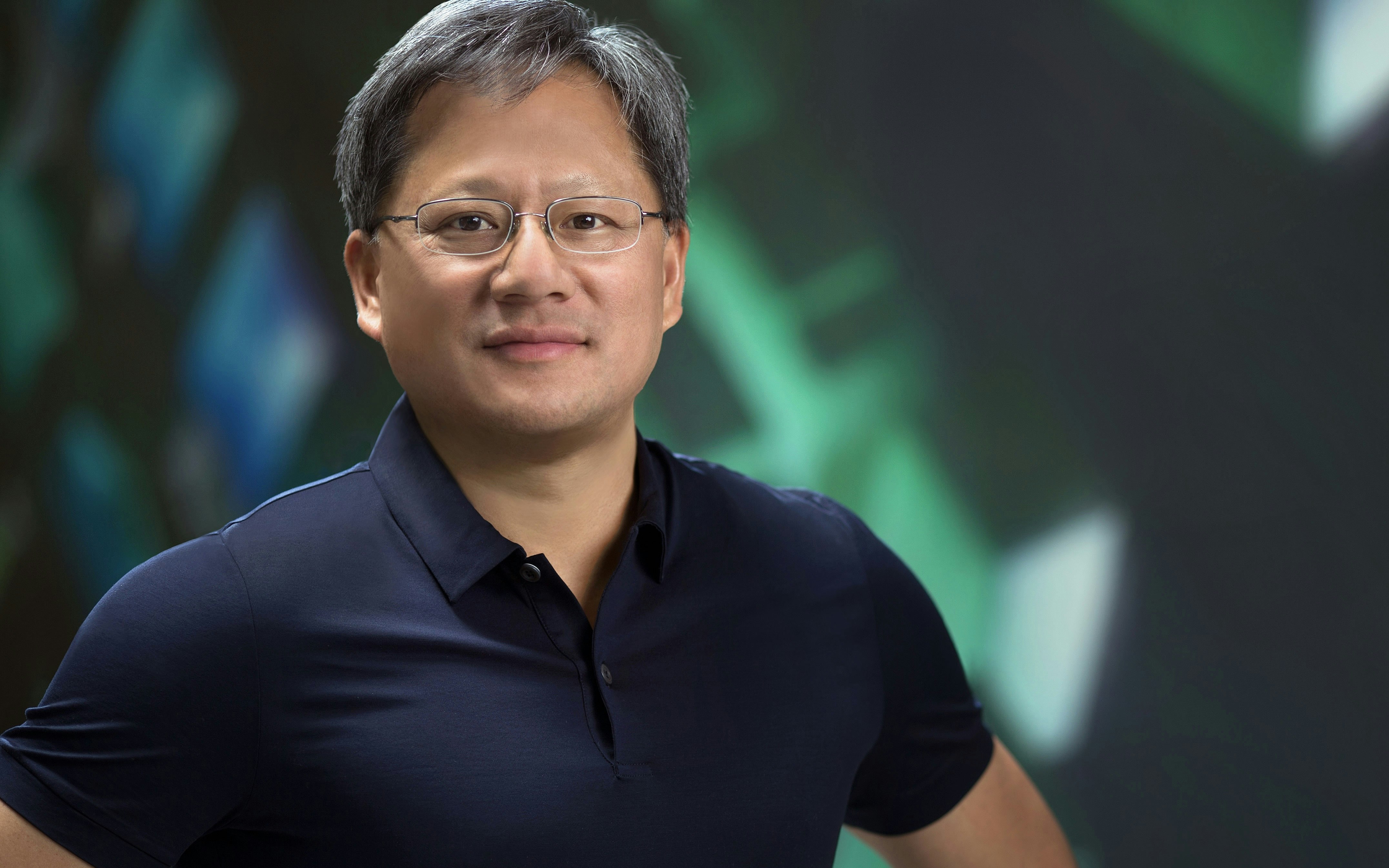

The Successful Chip Company Nvidia Records Another Set of Impressive Quarterly Figures. CEO Jensen Huang Presented a Revenue Jump of 265 Percent Year-over-Year to $22.1 Billion on Wednesday. With a Strong Presence in the Field of Artificial Intelligence (AI), Nvidia's Success Seems to Know No Bounds. The Latest Figures Also Confirm this, Identifying the Company as a Leading Provider of AI Chips.

The Background to the Enormous Growth: The Numerous Applications Driven by Nvidia's Chips. From the Text Robot ChatGPT to the AI Image Generator Firefly, to Videos Created with Artificial Intelligence - All These Innovations are Made Possible by Nvidia's Chips. "We Are Just at the Beginning of a Revolution," Huang Announced Proudly, Highlighting the Growing Use of AI in the Economy.

However, the company also faces challenges as the demand for high-performance AI chips far exceeds supply. This was reflected in the quarterly figures, which showed an impressive net profit of $12.3 billion or $4.93 per share, an increase of 769 percent over the previous year. This success is also evident in the stock market, where Nvidia's shares rose by ten percent, leading the Nikkei and the DAX to new record highs.

The Growth in the Data Center Business Segment was Particularly Notable, Where Nvidia Saw a Revenue Increase of 409 Percent. This is Attributable to the Constantly Increasing Demand for the H100 Chip, Which is Considered One of the Most Coveted Chips for Sophisticated AI Applications. Additionally, Meta CEO Mark Zuckerberg Announced in January That His Company Will Use 350,000 H100 Graphics Cards by the End of the Year, Indicating That Nvidia's AI Chips Worth Several Billion Dollars Will be Sold to Meta Alone.

Nvidia, however, is already in the process of introducing an improved chip, the B100, which is expected to surpass the performance of the H100. This semiconductor is even better suited for demanding AI applications and is set to be unveiled later this year. In the meantime, an enhanced version of the H100, the H200, is expected to be released, with shipping slated for the second quarter of the year. "We are on track, and the demand for the enhanced chips is already very high," explained Chief Financial Officer Colette Kress.

Nvidia's competitors may keep trying to break the company's dominance in the AI chip market, but CEO Huang remains unfazed. With an impressive 40 percent revenue share just in the area of so-called inferencing, which is the daily operation of AI models, Huang emphasizes the important role that Nvidia plays across the entire AI industry.

"However, alongside the successes, there were also setbacks, such as in the automotive sector, where Nvidia works closely with Mercedes to enable autonomous driving. Here, revenue fell by four percent in the last quarter compared to the previous year, which, however, is not surprising in light of the current challenges in the AI chip market."

Another obstacle is the export restrictions on high-performance chips to China imposed by the US government. This measure is intended to contain China as a competitor in the race for dominance in artificial intelligence. For Nvidia, however, this means the loss of a lucrative business. Chief Financial Officer Kress emphasized that revenue has declined significantly due to these restrictions. However, an exact figure could not be provided as sales to China are not listed separately in the financial statement.

Finally, given the strong quarterly figures and the company's maximum capacity utilization, CEO Huang issued an impressive revenue forecast of around 24 billion dollars for the current quarter. This would represent a 233 percent increase in revenue compared to the same period last year, highlighting Nvidia's undisputed position in the AI chip market. Gartner's chip expert, Alan Priestley, confirmed this and emphasized that the biggest challenge for the company at the moment is to meet the demand. Huang is certain: "Nvidia has left the competition behind."