Business

Li Auto forecasts more moderate sales figures after surge in revenue and profit

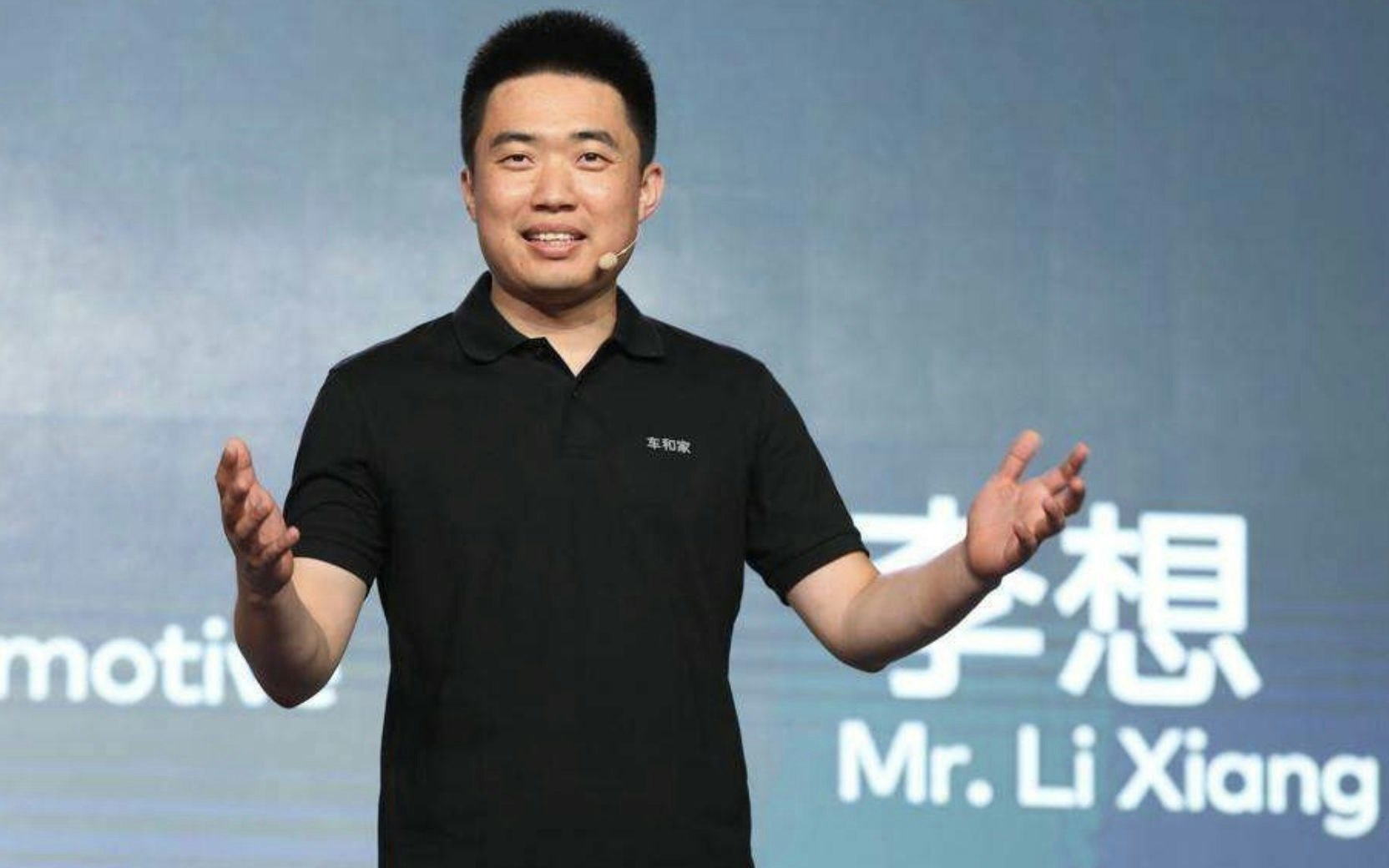

Li Auto, Chinese electric vehicle manufacturer, expects a decline in deliveries at the beginning of 2024 following a record quarter in 2023.

Chinese Electric Vehicle Manufacturer Li Auto Expects Sequential Decline in Deliveries in the First Months of 2024 - After a Record-Breaking Quarter Where Revenue and Profit More Than Doubled During the End of 2023.

The Beijing-based company announced on Monday that revenue in the fourth quarter more than doubled from the previous year, reaching 41.73 billion yuan ($5.80 billion), surpassing the consensus estimates of 40.20 billion yuan in an analysis conducted by data provider FactSet.

The deliveries of the popular SUVs from Li Auto and other vehicles increased from 131,805 units last year to almost three times that number. The net profit was 5.66 billion yuan, which was significantly above the 256.9 million yuan of the previous year as well as the 2.82 billion yuan in the third quarter.

This progress was made despite the ongoing "price war" in China with competitors such as Tesla, BYD, Nio, and XPeng. The gross margin in the fourth quarter rose to 23.5%, compared with 22.0% in the previous quarter. Li Auto expects to deliver between 100,000 and 103,000 vehicles in the first quarter of 2024, which would be the lowest figure since the second quarter of last year.

Revenue is estimated at 31.25-32.19 billion yuan, which is lower than the previous quarter but still above the value of the previous year. Monday's results also showed that Li Auto was able to achieve a net profit for the first time last year, with earnings of 11.70 billion yuan, significantly exceeding expectations of 8.91 billion yuan in a FactSet survey.

Total revenue in 2023 rose to 123.85 billion yuan. Li Auto's vehicle margin in 2023 was 21.5%, compared to 19.1% in the previous year. Capital expenditures in 2023 amounted to 6.51 billion yuan.