Professional strategies for your stock market success

Take financial freedom into your own hands with Eulerpool. Anyone can invest in undervalued stocks with Eulerpool, even without prior knowledge. Professional research support through tools developed by successful analysts. We explain the ideas behind each strategy, the historical results, and how you can apply them.

Quality Score for AlleAktien

In Germany, quality stocks are defined as stocks with an AAQS of 9 or 10 points. According to Bloomberg, these stocks achieve a 16% annual return.

Dividend Aristocrats

For many investors, dividend aristocrats are an important part of their dividend strategy to generate regular income. Dividend aristocrats are also referred to as the nobility because these companies prove to be extremely generous towards investors.

High dividend yield

Investors who follow the dividend strategy primarily buy stocks of companies with high dividend yields. This is to secure a passive income.

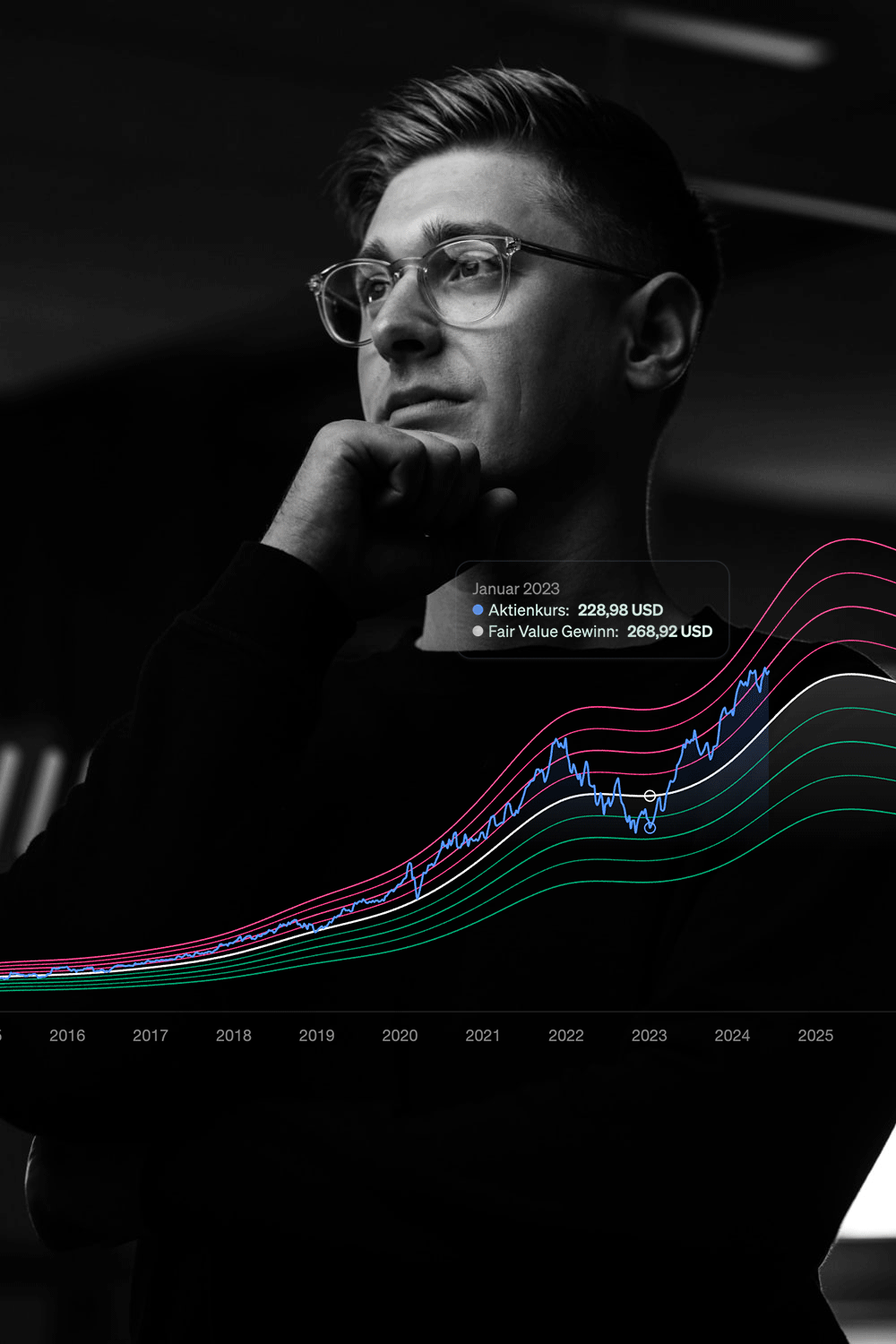

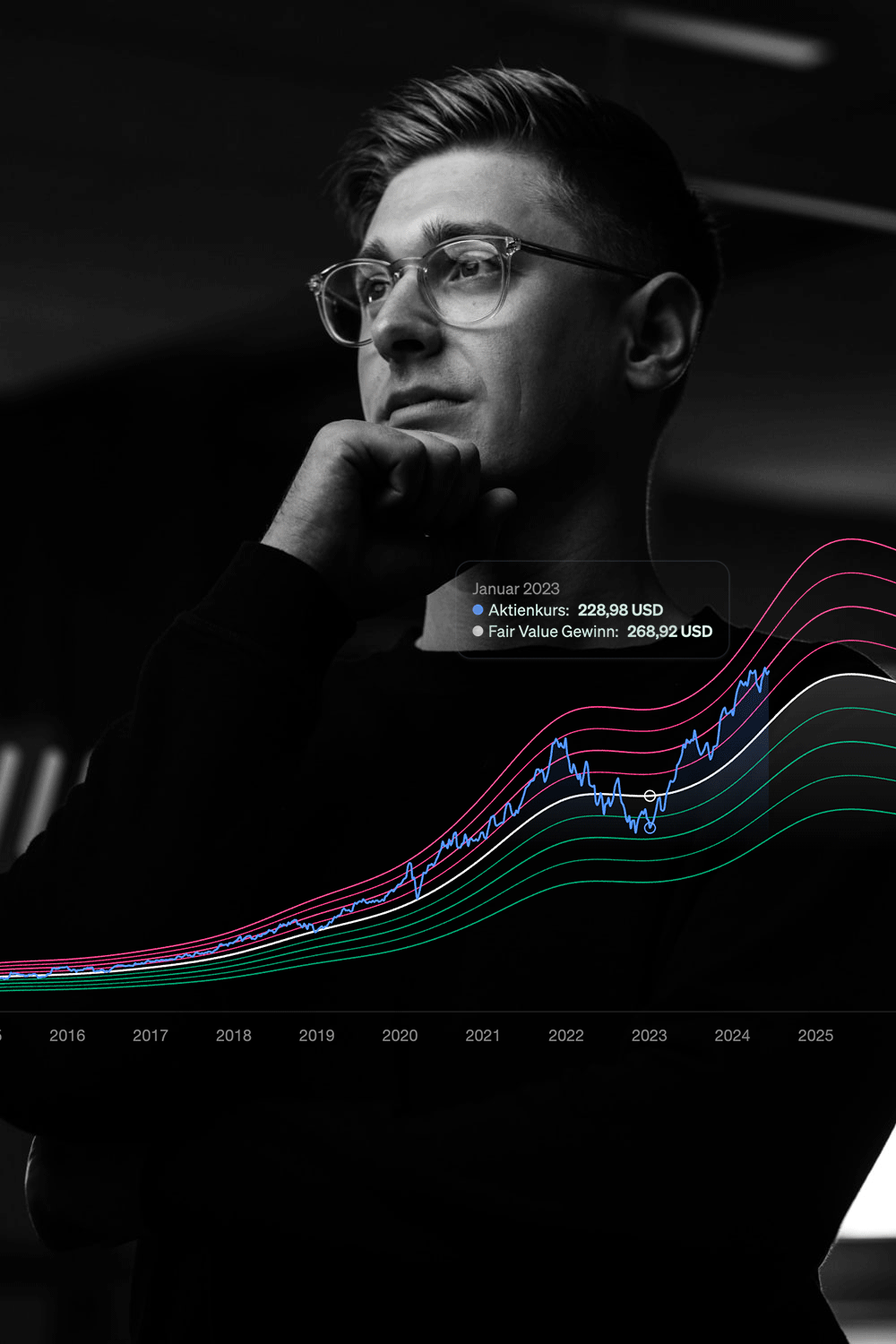

Undervalued Stocks

Prices are formed in the stock market through supply and demand. When prices fall, potential buyers are absent. There can be several reasons why stocks are traded below their fair value in the market.

Quality Investing

Quality stocks are defined in Germany as stocks with an AAQS of 9 or 10 points. According to Bloomberg, these stocks achieve a return of 16% p.a.

Levermann Strategy

Levermann Stock Analysis: Susan Levermann was one of Germany's most successful fund managers (DWS). She managed 1.7 billion euros there and was awarded for many years as the best stock fund in Germany.

High dividend yield

Investors who follow the dividend strategy primarily buy stocks from companies with high dividend yields. This is to secure a passive income for themselves.

Dividend Turbo

With the Dividend Turbo Strategy, it is possible to determine buy or sell signals based on the dividend yield, allowing one to quickly determine whether a dividend stock is undervalued or overvalued.

Dividend Aristocrats

For many investors, dividend aristocrats are an important part of their dividend strategy to generate regular income. Dividend aristocrats are also known as the nobility because these companies prove to be extremely generous towards investors.

Undervalued stocks

Prices are determined by supply and demand in the stock market. When prices fall, potential buyers are lacking. There may be several reasons why stocks are traded below their true value in the market.

The 100 most searched stocks

It is important for an investor to have an investment strategy because there is no one stock that fits into every portfolio. It depends on your risk tolerance which stocks you invest in.

The best stocks 2022

The basis of successful investing is always long-term profit growth. Stable profit growth not only increases the return on your investment but also reduces the risk of loss. The top 100 stocks worldwide are characterized by increasing profits over a longer period of time.

Rule of 40

The Rule of 40 originates from the Silicon Valley and is used there as an important indicator for technology companies. It was developed by venture capitalists to measure the success of small, rapidly growing companies in a simple way.

Scalable Capital

Create a savings plan with Scalable Capital? Eulerpool shows you how to do it and in which stocks you can invest.

Comdirect

Create a savings plan with Comdirect? Eulerpool shows you how to do it and which stocks you can invest in.

ING DiBa

Create a savings plan with ING DiBa? Eulerpool shows you how it works and which stocks you can invest in.

Consorsbank

Create a savings plan with Consorsbank? Eulerpool shows you how to do it and in which stocks you can invest.

Trade Republic

Creating a savings plan with Trade Republic? Eulerpool shows you how to do it and in which stocks you can invest.

DAX

The German Stock Index (DAX) represents the 40 largest companies of the German stock market, encompassing 80 percent of all German publicly listed corporations.

S&P 500

The S&P 500 (Standard & Poor's 500, SPX) includes the 500 largest US companies by market capitalization. The index is one of the three most important US indices.

NASDAQ 100

The NASDAQ 100 is a stock index for primarily American technology companies. It includes the most valuable 100 non-banks listed on the American stock exchange Nasdaq.

EURO STOXX 50

The EURO STOXX 50 includes the 50 largest companies from the Euro currency area. Therefore, companies from countries such as Switzerland or Sweden are not included in the index.

MDAX

The MDAX is the follow-up index to the DAX, which includes the 40 largest companies. The MDAX comprises the 50 largest companies/stocks that follow the 40 DAX companies. These mainly consist of mid-cap companies.

SDAX

The SDAX is the follow-up index to the MDAX, which includes the 50 largest companies after the DAX. The SDAX encompasses the 70 largest companies that come after the 50th MDAX company. These are mainly small-cap companies.

FTSE 100

The index includes companies based in the United Kingdom that are listed on the London Stock Exchange. The index is calculated and managed by the British company FTSE Group.

IBEX 35

The index Iberian Index 35 (IBEX) was established by the Madrid stock exchange on January 14, 1992. The index base is calculated retroactively to December 31, 1989. A starting value of 3,000 points was defined for that day.

Deutschland

Germany is the fourth largest economy in the world and the economically most important pillar in Europe. We are the export champion: Our cars, medicines, football, Bavarian beer and our highly specialized machines are known and popular worldwide.

USA

Economic Power USA. The country has the largest stock market, the two largest stock exchanges (NYSE and NASDAQ), and the most important indices.

China

The new economic power China? China is home to 1.42 billion people, which is more than the combined population of Europe and the USA. The interesting aspect is China's rise in recent history.

Singapur

Key hub in Southeast Asia. Singapore is one of the wealthiest countries in the world, but it has limited land and resources.

Schweiz

Switzerland has a remarkable economic power. The economy in Switzerland is heavily reliant on the healthcare and finance sectors. The largest and most well-known companies in Switzerland, such as Roche or UBS, predominantly operate in these sectors.

Österreich

Of course, tourism also plays a major role. The service sector also makes a significant contribution to the Austrian economy, which is globally recognized as one of the most advanced.

Kanada

Canada is the second largest country in the world, which for many years stood in the shadow of the USA and is now perceived as the land of trend stocks. Due to its vast natural resources, Canada is considered the most important trading partner of the USA, which greatly benefits the country economically.

Frankreich

The French economy, similar to the German economy, is dependent on the economic cycle. The largest sector in France is the cyclical consumption, which is particularly defined by companies in the luxury industry such as LVMH (Louis Vuitton Moët Hennessy), Kering, and Hermès, as well as companies in the automotive industry such as Renault.

Großbritannien

The United Kingdom (UK) consists of several islands divided into four parts: England, Wales, Scotland, and Northern Ireland. England, particularly the capital city of London, represents the largest economic region.

Spanien

The Spanish economy represents the twelfth largest economy in the world. The most important sectors of the economy are tourism, communication and information technology, metal processing industry, mechanical engineering, agriculture, and petrochemistry.

Italien

Italy's economy has been increasingly privatized in recent years and has experienced an economic upswing since 2006. However, it suffered a strong setback during the financial and banking crisis in 2008.

Japan

Japan is the third largest economy in the world. The Japanese economy has grown significantly in the last century. With a lot of capitalism, diligence, and innovative power, Japan managed to catch up with the USA and become a global power, and it still has a lot to catch up on.

Hongkong

Hong Kong is one of the four Asian Tiger economies (including Taiwan, South Korea, and Singapore). These four Asian Tiger economies are the countries that have experienced phenomenal growth since 1970, going from being among the poorest regions in the world to becoming some of the wealthiest.

Indien

India is the seventh largest economy in the world. Additionally, it is the fastest growing major nation. India will be the most populous country in the world by 2023-2025. Population and wealth growth are driving the country forward.