CEO Christian Bruch presents an action plan to rescue the struggling wind division at Siemens Energy. Despite announced savings of 400 million euros, according to Bruch, it will still take years to restructure the sector.

After billions in losses, the crisis-ridden company plans to reduce investments and growth in the wind power business, especially in the onshore sector. On the other hand, the production of offshore turbines is to be expanded. Bruch emphasized at the capital market day in Hamburg that the turnaround of Siemens Gamesa continues to have top priority and the success of the entire company depends on a functioning wind business. Nevertheless, he expects profits only in three years.

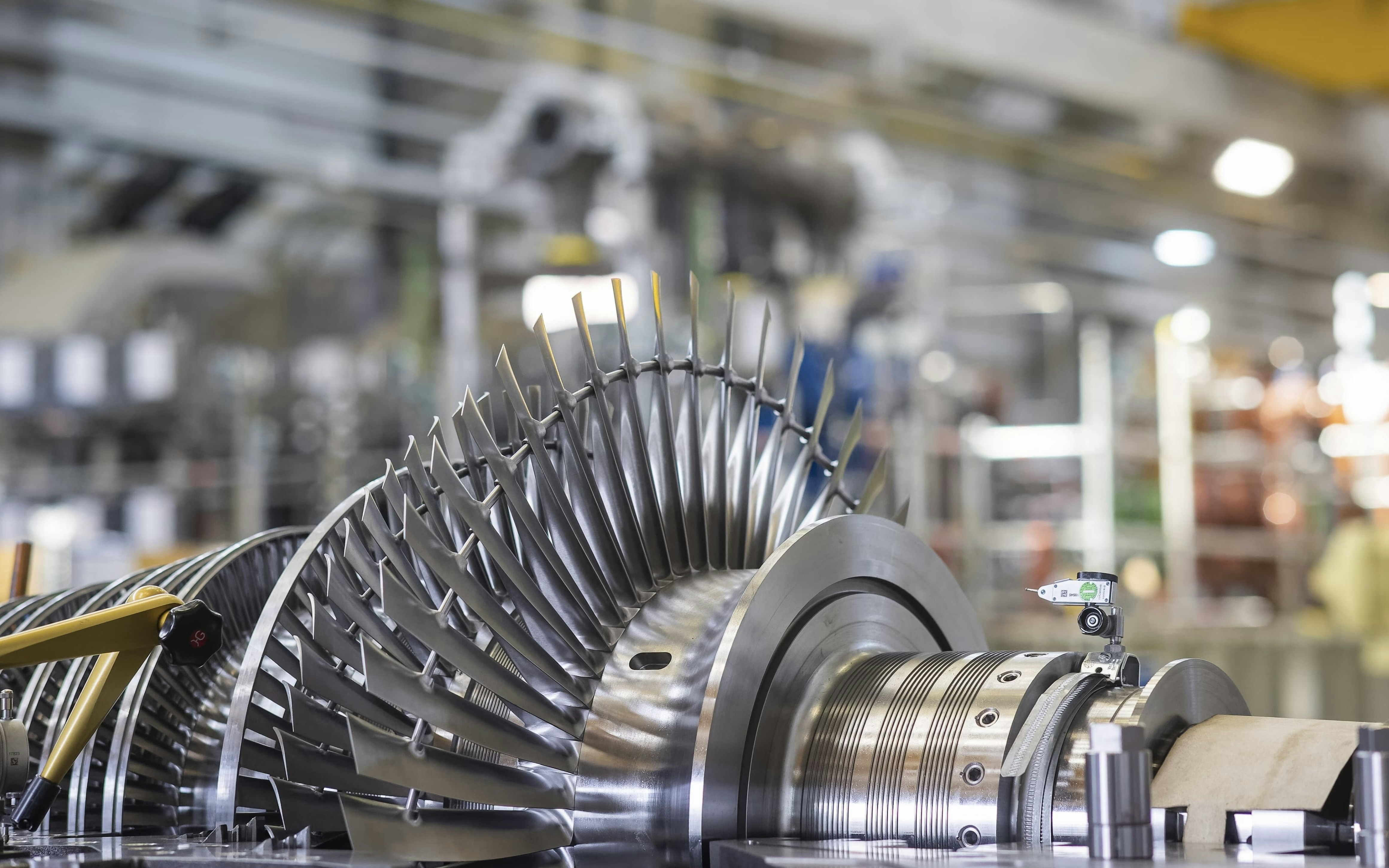

Siemens Energy has been fighting for the restructuring of its wind subsidiary, Siemens Gamesa, for the past three years. Profit warnings, quality issues, and a challenging market environment have weighed on the company's overall performance, leading to its recent need for state guarantees to be rescued. The government, as well as banks and major shareholder Siemens, have participated with guarantees amounting to 15 billion euros to give the company two years to restructure its wind business. This has instilled some confidence among investors, leading to a rise in the share price, but it has not reached pre-crisis levels. While the divisions for gas power plants, power grids, and the future expansion called "Transformation of Industry" are generating profits, the wind power division alone recorded a loss of 670 million euros in the fourth quarter.

The sale of new onshore turbines is temporarily suspended due to quality problems and has significantly affected revenue and order backlog. The difficulties are mostly self-inflicted: the problematic turbine was brought to market too early under intense competition pressure. In addition, inflation, rising interest rates, and fierce price competition among turbine manufacturers contribute to the current situation, causing no major manufacturer to generate profits.

Siemens Energy investors demanded a clear wind strategy from CEO Bruch, as he has to fear for his job if the restructuring fails. However, he did not present a completely new strategy at the Capital Market Day, but emphasized that Siemens Energy will overall continue to focus on wind power. Currently, a withdrawal from the onshore sector is also not up for discussion, even though the Onshore 5.X platform was a disaster. Exiting would not be easily feasible due to the large order backlog.

Siemens Energy plans to adopt a more selective approach in wind power for the future, both in terms of products and markets. It is expected that prices will continue to rise, following an increase of over 20 percent in the last two years. In the offshore sector, production capacities will be increased, but the markets in which the company operates will be more specifically chosen. The issues in the offshore factory in Cuxhaven, including delivery difficulties and improved workflows, will be addressed through the establishment of a larger inventory. The production will be outsourced, with Siemens Gamesa being responsible only for the assembly of the nacelles and the manufacturing of the rotor blades. To prevent future problems, such as those encountered with the 5.X generation, suppliers will be involved earlier in the development process.

The difficult situation in the offshore market could even help Siemens Gamesa. The overall economic situation is causing projects with high capital requirements, such as offshore wind farms, to be currently halted. Operators such as Vattenfall and Orsted have announced that planned projects on the British and North American coasts will not be built. According to company sources, Siemens Gamesa is even hoping for such cancellations in order to stabilize its own wind business.