Business

Vanguard Ventures into the Active Bond Market

Vanguard plant, with a massive expansion in the active bond market, to reduce costs and create transparency in order to gain new market share.

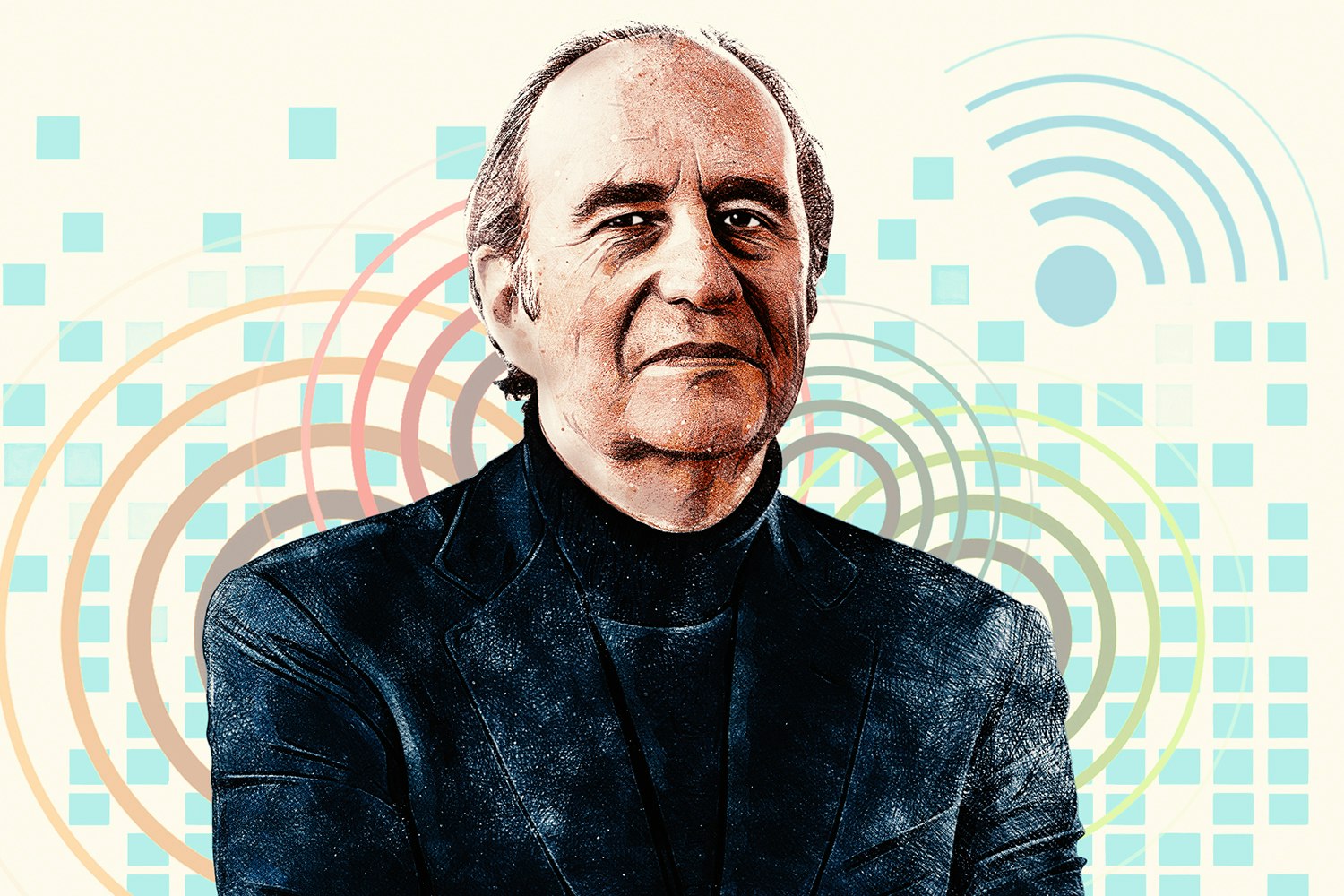

Vanguard, the world's second-largest asset manager, plans to expand its presence in the active bond market. CEO Salim Ramji sees "exceptional inefficiencies and opportunities" in this segment. While Vanguard has been primarily known for its equity business, the expansion in the fixed-income securities sector is now being prioritized. Approximately 10 percent of the currently managed assets of $9.7 trillion are invested in active bond funds.

Ramji, who has been leading Vanguard since July, spoke at a Financial Times conference, criticizing the bond market as "outdated, opaque, and expensive." He sees an opportunity to leverage Vanguard's strength to change the dynamics in this market. The goal is to reduce costs and increase transparency – similar to how Vanguard has already achieved this in the stock market with its low-cost products.

Ramji emphasized that the bond market would gain importance in the coming years, especially as more people retire. "The inefficiencies in the bond market are extraordinary," said Ramji. Vanguard's actively managed bond funds, for instance, cost only 14 basis points, significantly less than those of other active providers.

This step could shake up the bond industry as Vanguard's move will likely lead to price competition. While the company has already revolutionized the stock business, focusing on bonds could have similar impacts. Observers like Dan Sotiroff from Morningstar see this step as a consistent continuation of the already begun expansion into the bond market.

Vanguard is known for its low-cost index funds and has invested 80 percent of its assets in passive funds. The move into the active bond market comes at a time when the company is under pressure from both the political left and right in the USA due to its size and influence on the market.

In summary, this step shows that Vanguard is preparing to transform the fixed-income market – much like it has already succeeded in doing in the equities sector.