The Taste of Crisis

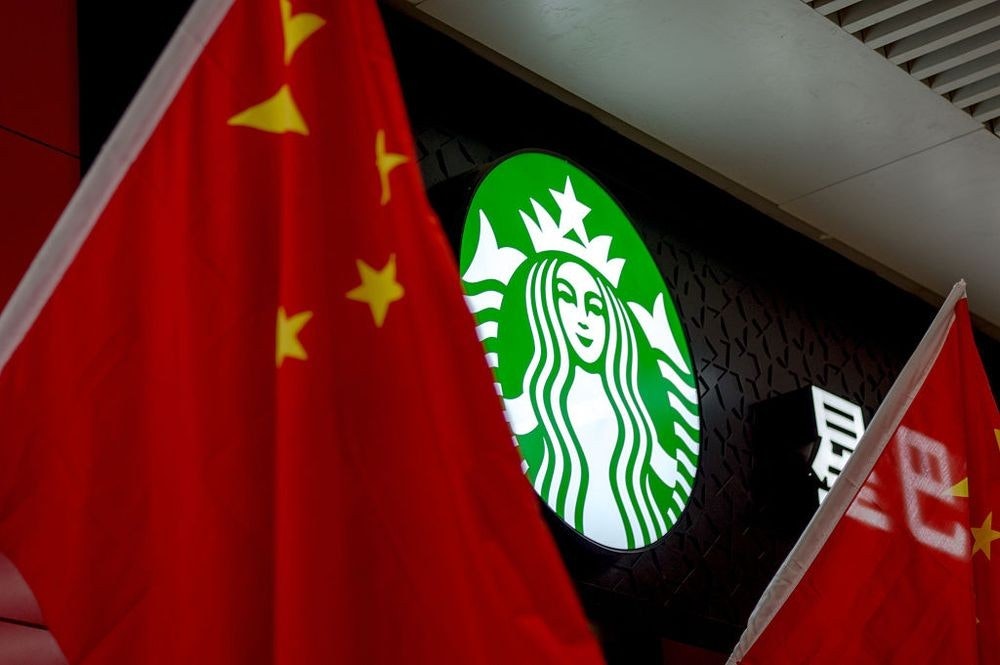

Starbucks was once considered a status symbol in China. Those who drank their coffee-to-go there showed taste - and money. But the image is beginning to crumble. As the economy stagnates, local competitors like Luckin Coffee are taking the milk foam off the Americans' cappuccino. The main reason: price and pop culture. A latte macchiato at Luckin often costs only a third of what Starbucks charges. In addition, there are marketing strategies that hit the nerve of young Chinese.

Now Starbucks Strikes Back – with Tony Yang. The former manager of Jiyue Auto has settled in as "Chief Growth Officer" in China since November. His mission? To bring the Starbucks brand back into the spotlight with the help of pop culture and innovative partnerships.

The Plan: Coffee Beans Meets Pop Icons

Yang has big plans. Instead of relying solely on the iconic Starbucks brand, he is focusing on partnerships with entertainment franchises and pop culture giants. What does that look like? Currently, it remains a secret, but a look at the competition reveals where the journey might go.

Luckin Coffee leads the way: Whether it's an alcoholic latte with the premium brand Kweichow Moutai or collaborations with popular video games like Black Myth: Wukong – the concept works. The social media world virtually exploded, and revenues soared. A similar approach could give Starbucks the much-needed boost.

Innovation or Desperation?

But it's not just about marketing. Product development and customer service are also in focus. Yang wants to improve the experience for customers and make the coffee itself more innovative. Whether that means Starbucks versions of "Bubble Tea" or Moutai Latte will soon appear remains to be seen.

The goal is clear: Win back Chinese customers before they turn permanently to local alternatives. With 7,600 stores, China is Starbucks' largest international market—and an essential growth driver. But recent numbers look bleak: a 14 percent decline in comparable sales last quarter.

The competition never sleeps

While Starbucks struggles, the competition does not stand still. Last year, Luckin Coffee achieved higher sales in China for the first time than Starbucks. Brands like Miniso and Pop Mart also show how to inspire the masses with clever marketing concepts – be it with Disney toys or "blind boxes" full of surprise figures.

Starbucks is under pressure, mainly because the brand no longer has the exclusivity it once had. Young Chinese, once fascinated by Western brands, are increasingly turning to more local, price-conscious alternatives.

The customer has the final say

Starbucks' new CEO, Brian Niccol, will personally travel to China to assess the situation. It is a symbolic step that shows how serious the company is. But whether pop culture and product innovations are enough to save the brand will be decided by the customer alone.

A lot is at stake for Starbucks - and Tony Yang is now responsible for reinventing the coffee giant in its most important international market. The pressure is on.