The British insurer Resolution Life is being acquired by the Japanese Nippon Life. The transaction, which values the company at $10.6 billion, marks the largest acquisition of a Japanese insurer overseas. Nippon Life, already holding a 23 percent stake in Resolution Life, will pay $8.2 billion in cash for the remaining shares. The acquisition is expected to be completed in the second half of 2025.

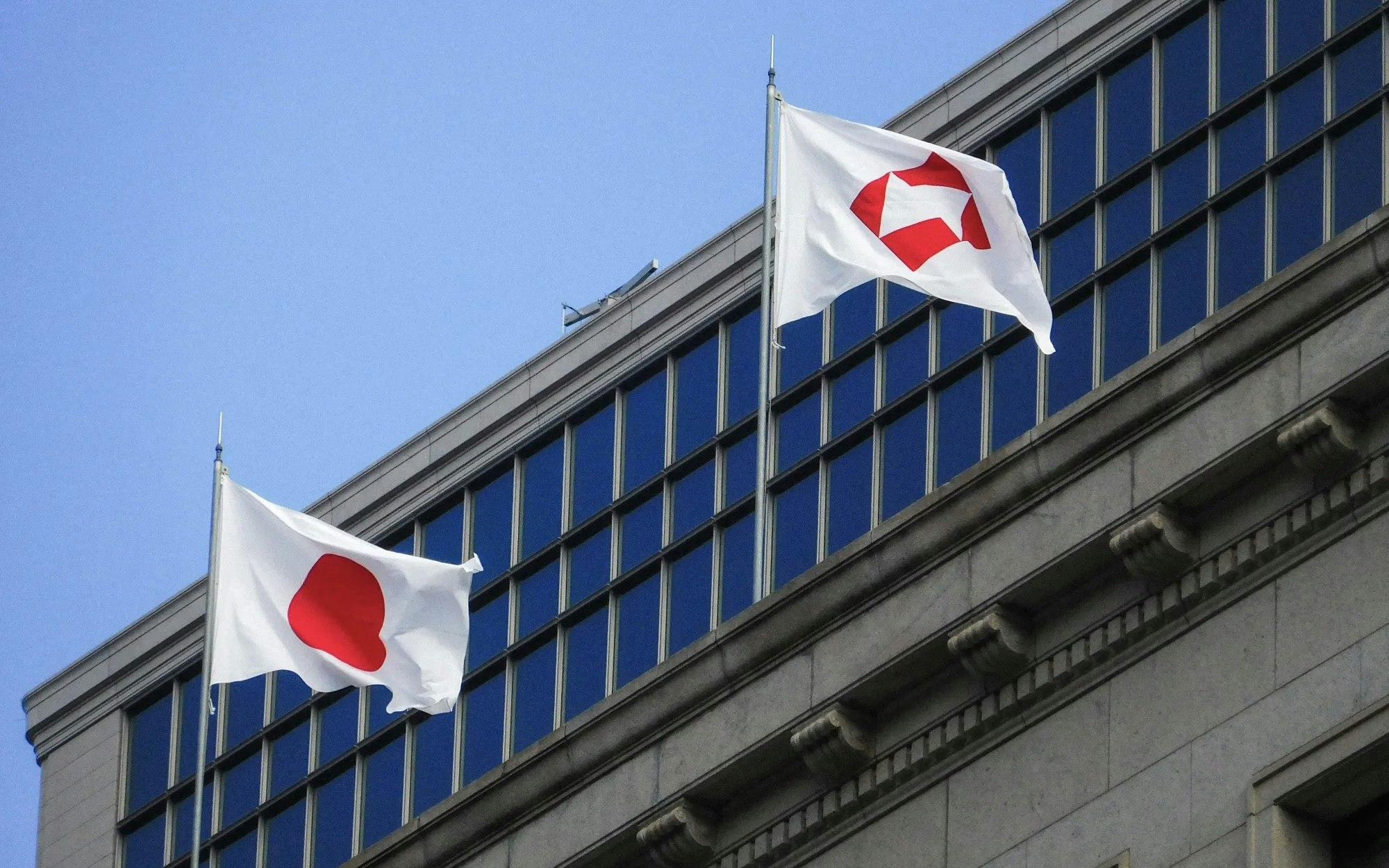

With the acquisition, Nippon Life strengthens its presence in the international insurance market. The group, which serves 15 million customers and manages assets of 87 trillion yen ($570 billion), is increasingly reliant on foreign markets due to Japan's shrinking and aging population. The purchase of Resolution Life follows Nippon Life's acquisition of a 21.6 percent stake in the American company Corebridge for $3.8 billion in May this year.

Sir Clive Cowdery, founder and CEO of Resolution Life, will lead the company until 2026 before handing over the role to current president Moses Ojeisekhoba. Cowdery took the opportunity to dismiss criticism of the economic orientation of the British Labour government. "The claim that the current government is not business-friendly is complete nonsense," he said. At the same time, he criticized the economic mismanagement of the previous conservative government, particularly in relation to Brexit.

The U.S. private equity giant Blackstone, one of the previous investors of Resolution Life, will continue to act as an investment manager for parts of the portfolio. "The combination of Resolution Life's strengths, Blackstone's investment expertise, and a well-funded parent company provides the opportunity to accelerate our growth," Cowdery explained.

A large portion of Cowdery's profits from his entrepreneurial activities flows into the Resolution Foundation, a think tank dedicated to combating poverty. For his commitment, he was knighted in 2016. Cowdery did not provide information about his personal involvement in the sale and the potential proceeds.

The acquisition by Nippon Life exemplifies the international growth strategy of Japanese insurers. After a phase of intense acquisition activities a decade ago — for example by Dai-ichi Life and Meiji Yasuda — the industry has recently shifted its focus back to foreign markets to secure long-term returns.