Business

Kioxia prepares for expansion with an 800-million-dollar IPO

Kioxia uses the IPO for expansion and focuses on increasing demand for chips for AI and data centers.

The Japanese chip manufacturer Kioxia Holdings has announced the pricing for its highly anticipated IPO. The shares are offered at 1,455 yen each, which is approximately 9.70 dollars and is in the middle range of the projected price range. The company plans to start trading on the Tokyo Stock Exchange on December 18 to secure capital for the growing demand for chips in the areas of artificial intelligence (AI) and data centers.

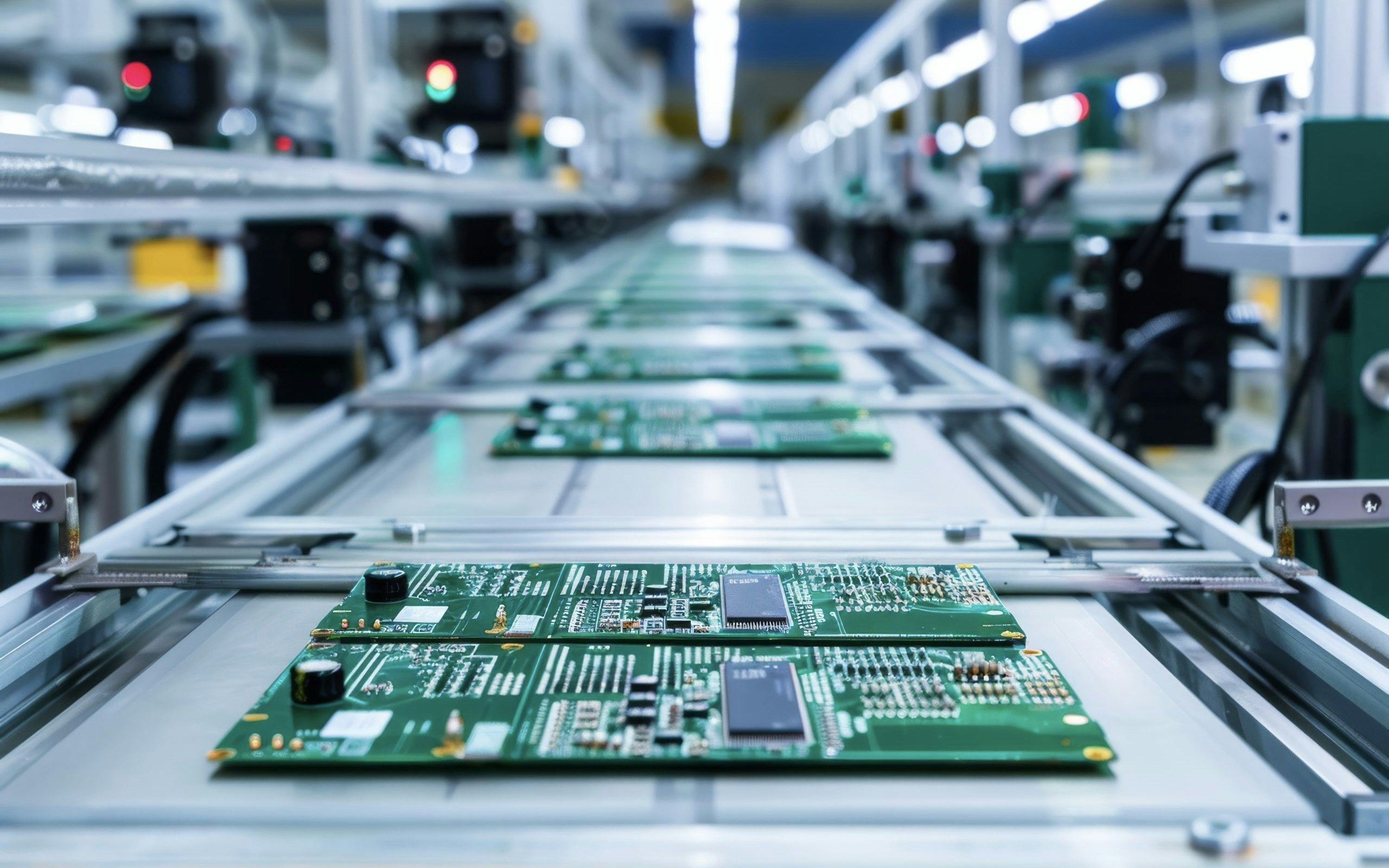

Kioxia, formerly Toshiba Memory, specializes in NAND flash memory chips used in smartphones, servers, and other devices. The company expects significant growth in this segment in the coming years, particularly due to the increasing demand for AI applications and data infrastructure.

The company was acquired by Bain Capital for $18 billion in 2018, with Toshiba retaining a 40 percent stake. The planned capital increase includes the issuance of 21.6 million new shares, while existing shareholders like Toshiba and Bain Capital will sell a total of 50.4 million shares. The total issuance amounts to 82.7 million shares, which corresponds to approximately 120 billion yen ($800.2 million).

Kioxia impressed in the first half of fiscal year 2024 with a net profit of 176 billion yen and a sales increase of 85 percent to 909 billion yen, after recording a loss in the same period of the previous year. Nevertheless, the company reported a net loss for the fiscal year ending in March, due to declining sales in a volatile market environment.

The proceeds from the IPO are to be specifically invested in capacity expansions and efficiency improvements to better meet the expected market demand. Kioxia secured additional financial stability in June by extending loans amounting to 540 billion yen and a new credit facility agreement for 210 billion yen.

The IPO takes place in a favorable market environment: The Nikkei Index reached new record highs this year, supported by strong corporate profits and a weak yen. The issuance follows several major IPOs in Japan, including the $2.31 billion stock market debut of Tokyo Metro in October and the $850.6 million listing of Rigaku Holdings, backed by Carlyle Group.

By going public, Kioxia strategically positions itself to benefit from the global demand for high-performance chips and to strengthen its market position.