ASML plays a crucial role in the production of high-performance chips that are of great importance for the use of Artificial Intelligence (AI). The stock of the Dutch company is at a record level and analysts' opinions on the future of the stock are divided.

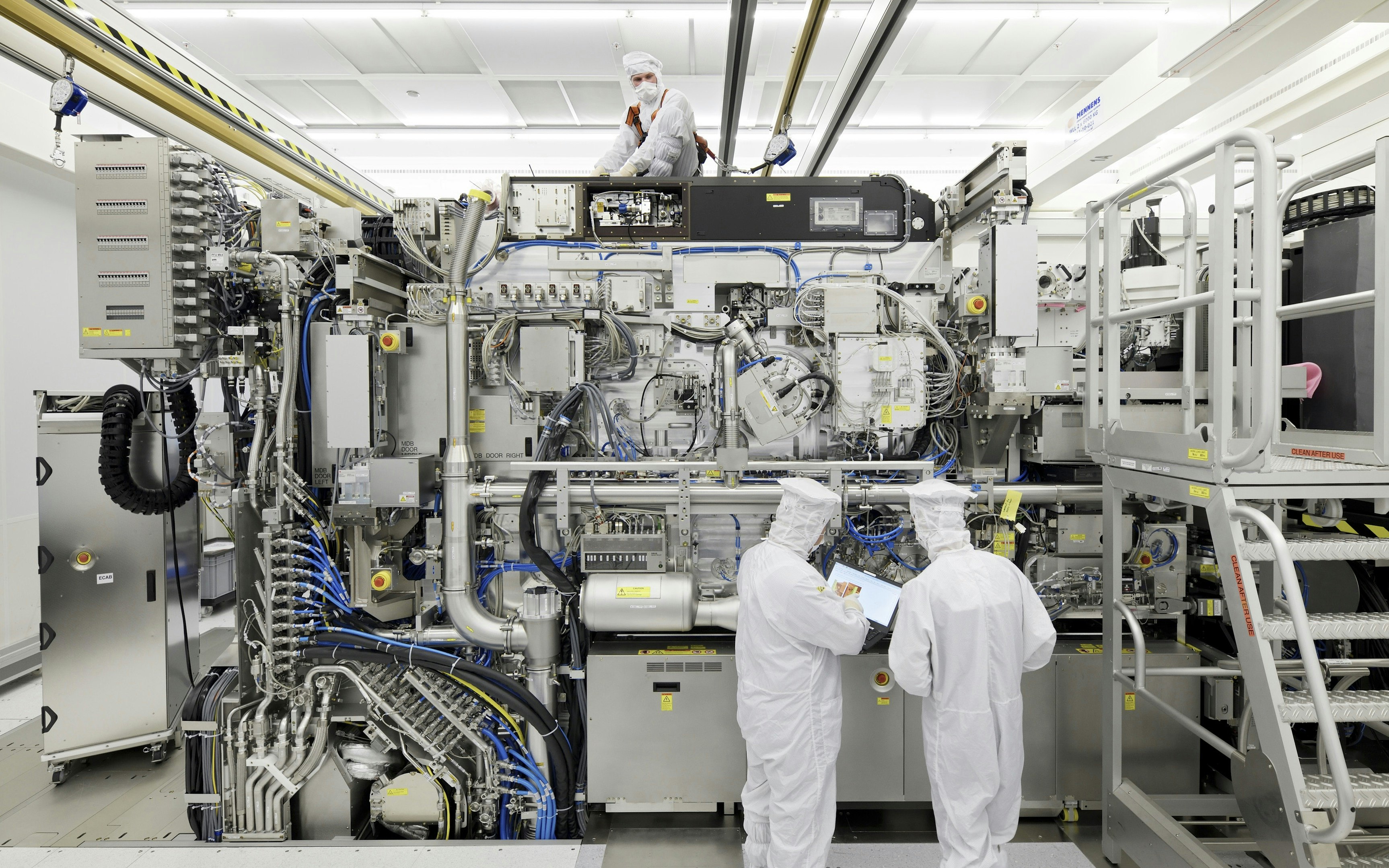

Without ASML's machines, chipmakers like Nvidia would not be able to achieve new revenue and profit records. The company is the leading manufacturer of so-called EUV systems, which enable the production of ever smaller, more efficient, and faster microchips. These powerful semiconductors are indispensable for the increasing use of AI and are referred to by the scientists of the Fraunhofer Society in Munich as "new light for the digital age." Investors have also recognized the significance of ASML, which led to the stock reaching a new record value of 885.50 euros on Tuesday.

Analysts' opinions on the future development of the stock are divided, however. Alexander Duval from Goldman Sachs believes that the stock still has further potential for price increases and could reach a target price of 980 euros in the next twelve months. Sandeep Deshpande from JP Morgan also predicts a rise to 950 euros. Other analysts see a consolidation coming after a 30 percent increase since the beginning of January. UBS and Bernstein Research rate the stock as fairly valued, while Barclays rates it neutral with a target price of 650 euros. The average target price of the analysts monitored by LSEG is 880 euros. Overall, however, most of the 35 analysts are convinced by the ASML stock, with 26 recommending to buy and nine currently advising to hold.

ASML is indispensable for most chip manufacturers, as the company is a global leader in some critical semiconductor manufacturing processes. Customers include Nvidia as well as industry giants like TSMC and Intel. Consequently, at the stock market, ASML is the highest-valued technology corporation in Europe with a current market value of just under 350 billion euros. However, this also makes the stock relatively expensive, with a price-to-earnings ratio of 42.

During the presentation of the figures for the fourth quarter of 2023, CEO Peter Wennink announced that the year 2024 will be a transition year for ASML. The industry continues to be in the trough of the investment cycle, but the strong order intake in the last quarter indicates future demand. With an order backlog of 39 billion euros, of which 9.2 billion euros were received in the fourth quarter alone, the company is well-positioned. For the full year 2023, ASML reports a net sales of 27.6 billion euros and a net profit of 7.8 billion euros. The forecast for 2024 is similar, but the board describes it as conservative and is preparing for significant growth in 2025.

One of the biggest uncertainties for ASML is business with China. The Netherlands is following the USA's request for a ban on the import of key technologies into the Chinese economy, which also affects ASML. It remains to be seen whether additional demand from the USA and other countries can compensate or even overcompensate for the slump in China. However, the trend towards the localization of chip factories in North America and Europe is creating new sales and profit potential for ASML. Especially in the emerging era of AI, the demand for modern microchips is expected to continue to rise. Therefore, in the long term, ASML stock is considered promising - despite the existing China risk.