Technology

ASML surprises: Strong fourth quarter and significant increase in orders

ASML on the rise: Significant business recovery in the final quarter of last year for the chip equipment giant.

ASML was able to achieve a significant recovery in the fourth quarter of last year. According to analysts, the chip equipment supplier, which is a part of the SCHWACK STOXX50, exceeded expectations. New orders jumped threefold, after a sharp decline in the previous quarter.

Group CEO Peter Wennink expressed restraint but referred to 2024 as a transitional year for ASML. "The semiconductor industry is still struggling through the bottom of the cycle," he said according to a statement in Veldhoven. However, there are initial positive signals, such as an improvement in inventory levels at the end markets.

Investors showed delight at the strong year-end of Europe's most valuable technology company on the stock market. The stock rose in the morning, reaching up to seven and a half percent at 760 euros, making it one of the favorites in the European leading index, and approaching the record high of 777.50 euros in November 2021. By midday, the stock increased by an additional 6.69 percent to 754.40 euros. Over the past few months, the stock had already significantly recovered from a low point in October.

In a first reaction, Janardan Menon from investment bank Jefferies praised ASML's financial results and pointed in particular to the surprisingly high order intake. This supports the strong outlook for 2025. "We remain strong buyers of ASML," was his conclusion. In the fourth quarter of 2023, new orders worth nearly 9.2 billion euros were received by ASML, compared to only 2.6 billion euros in the previous quarter.

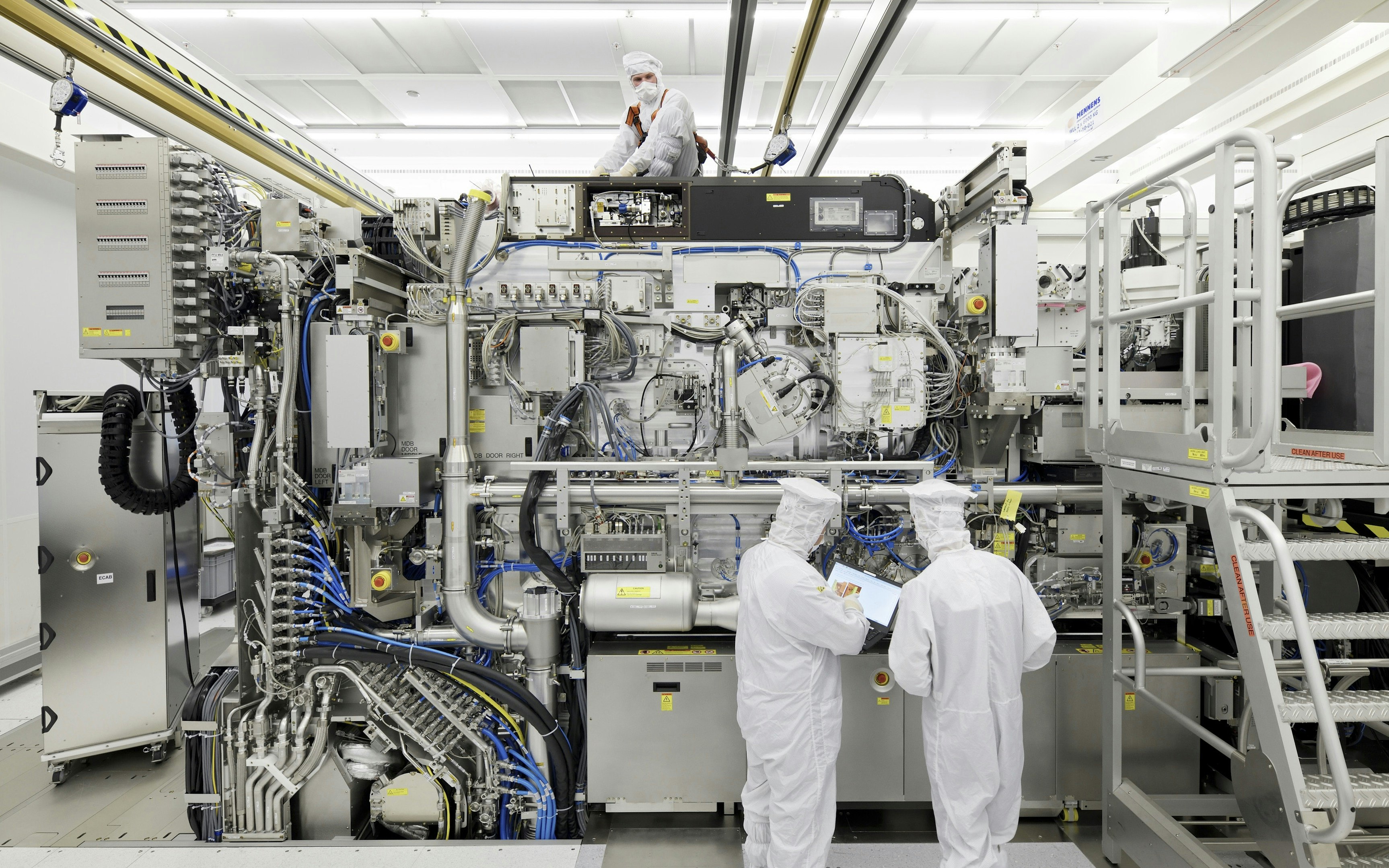

Of these, 5.6 billion euros were accounted for by EUV lithography systems, for which ASML is the only manufacturer with a quasi-monopoly. Analysts did not expect such a significant recovery and had only expected new orders worth 3.6 billion euros.

The turnover of ASML was over 7.2 billion euros and the gross margin was 51.4 percent, which also exceeded market expectations. CEO Wennink also sees the development positively. "Our strong order intake in the fourth quarter indicates strong future demand," he said.

By the end of 2023, ASML had an order backlog of 39 billion euros, yet Wennink remains cautious and sticks to the previous forecasts, which are considered conservative. Accordingly, the management expects a stable revenue for 2024 compared to 2023. At the same time, the company is preparing for an important year in which it hopes for significant growth in 2025, added the ASML CEO.

The semiconductor industry has experienced a boom in recent years, which was partly due to the high demand for technology products during the coronavirus pandemic. However, recently the industry has been facing a crippling slump, causing manufacturers to withhold orders from ASML.

Despite the general weakness in the industry, the company was able to significantly increase its profit last year, partly due to the increasingly challenging business with China. With a sales increase of around 30 percent, the profit rose by just under 40 percent to over 7.8 billion euros.

Shareholders receive a dividend of 6.10 euros per share, an increase of approximately five percent compared to the previous year. ASML is currently under strong political pressure from the USA, who are closely scrutinizing the extensive China business of the Dutch company.

Due to export restrictions, ASML was already not allowed to deliver EUV systems to the People's Republic of China, which are necessary for the production of advanced semiconductors. At the beginning of the year, the Dutch government, at the urging of the USA, also revoked the license to deliver lithography systems with deep ultraviolet light (DUV), as a result of which ASML could no longer supply Chinese customers.

In the past year, ASML's business in China significantly increased due to the restrictions, but in the fourth quarter, the share fell to 39 percent compared to 46 percent in the previous three months. However, ASML emphasized that the measures taken by the US government and the Netherlands have no significant impact on the financial outlook.

The British investment bank Barclays has maintained its "Equal Weight" rating for ASML despite the announcement of the figures and set a target price of 610 euros. The semiconductor equipment supplier unexpectedly reported strong order intakes, which, according to analyst Simon Coles, increases hope that 2025 will be a strong year for the company. However, the dividend for 2023 was slightly below expectations.