AI

OpenAI Facing Restructuring: Tensions with Microsoft and Legal Challenges

OpenAI plans the transition to a for-profit structure, but faces regulatory hurdles and criticism regarding the valuation of the non-profit shares.

OpenAI faces a significant restructuring, transitioning from a non-profit organization to a for-profit Public Benefit Corporation (PBC). Negotiations are challenging, particularly concerning the valuation of Microsoft's shares, the company's largest investor. According to people familiar with the discussions, OpenAI's non-profit entity could be valued at approximately 30 billion USD.

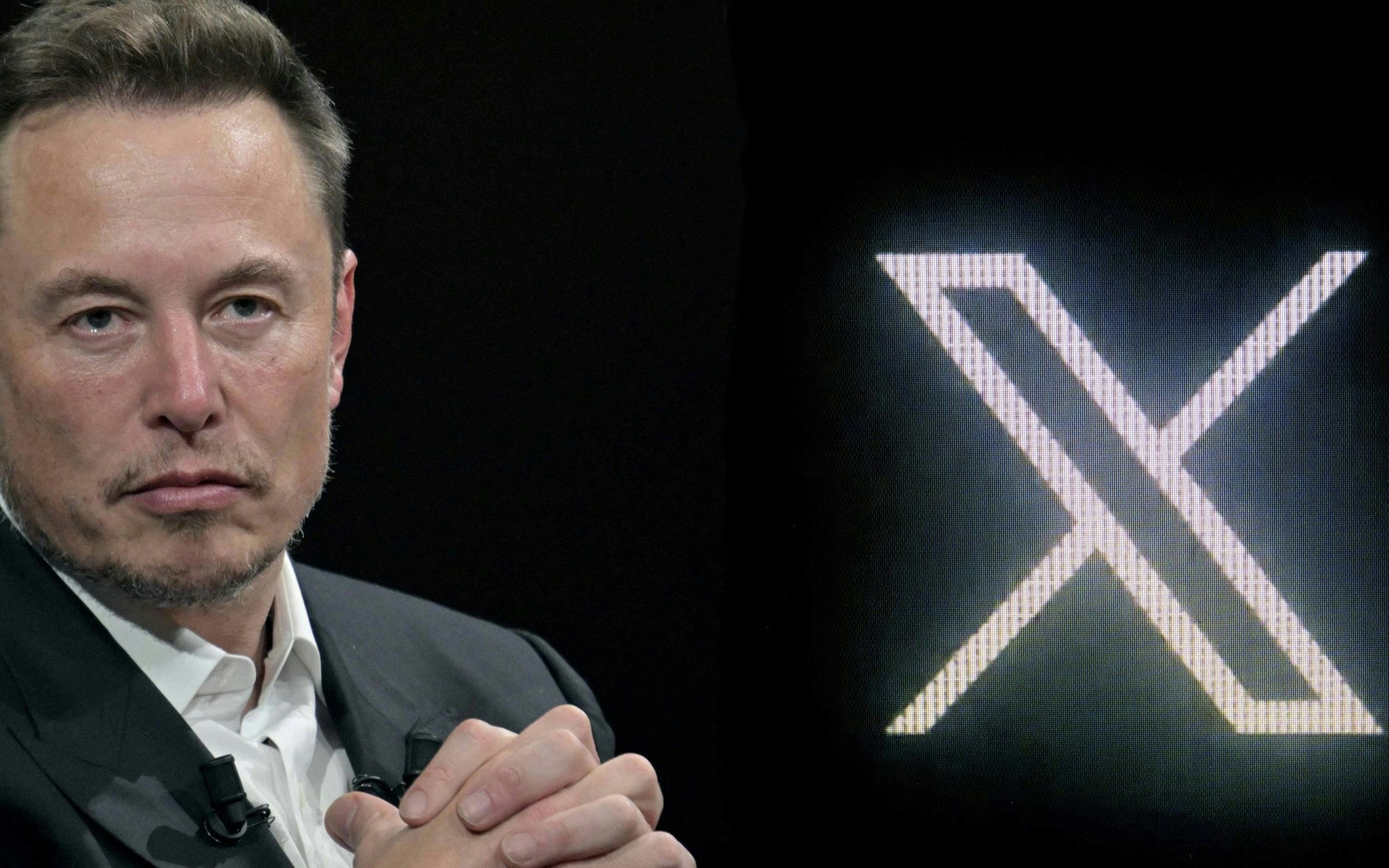

The planned conversion is intended to enable OpenAI to acquire further billions in investments to advance the development of advanced AI models and stay ahead of the competition. However, critics such as Elon Musk, a co-founder of the company, warn against a sell-out of the original mission to "serve humanity." Musk recently filed a lawsuit against the planned restructuring, claiming that OpenAI misled early investors about its long-term intentions.

A central issue in the planned transformation is the valuation of Microsoft's stake in the new corporate structure. OpenAI must ensure that the technology company does not gain a dominant position to avoid regulatory hurdles. Microsoft, which has invested $13 billion in the company, recently stated that it is also willing to allow OpenAI access to competing cloud services.

In parallel, OpenAI has recently entered into a partnership with SoftBank for the infrastructure project Stargate, which aims to invest up to 500 billion US dollars in AI technology in the USA.

The planned restructuring has attracted attention not only in the technology sector but also at the political level.

The negotiations on the transformation are to be concluded by the end of the year, but internal circles assume that there could still be delays. If the deadline is not met, investors like Microsoft could reclaim parts of their previous deposits.