K&S Corporation Stock KSC.AX

Price

K&S Corporation stock price

Details

Price

ⓘOverview

The Quote Chart provides detailed and dynamic insights into the K&S Corporation stock's performance, showcasing daily, weekly, or monthly aggregated quotes. Users can switch between different time frames to analyze the stock's progression meticulously and make informed investment decisions.

Intraday Feature

The intraday feature provides real-time data, allowing investors to view the K&S Corporation stock’s price fluctuations within the trading day, facilitating timely and strategic investment decisions.

Total Return and Relative Price Change

View the total return of the K&S Corporation stock to gauge its profitability over time. The relative price change, based on the first quote available in the selected timeframe, offers insights into the stock’s performance, assisting in evaluating its investment potential.

Interpretation and Investment

Utilize the comprehensive data presented in the Quote Chart to analyze K&S Corporation's market trends, price movements, and potential returns. Make informed investment choices by comparing different time frames and evaluating intraday data for optimized portfolio management.

| Date | K&S Corporation Price |

|---|---|

| 2/19/2026 | 3.40 AUD |

| 2/17/2026 | 3.48 AUD |

| 2/16/2026 | 3.48 AUD |

| 2/13/2026 | 3.39 AUD |

| 2/12/2026 | 3.38 AUD |

| 2/11/2026 | 3.39 AUD |

| 2/10/2026 | 3.40 AUD |

| 2/6/2026 | 3.48 AUD |

| 2/3/2026 | 3.49 AUD |

| 2/2/2026 | 3.45 AUD |

| 1/30/2026 | 3.40 AUD |

| 1/29/2026 | 3.40 AUD |

| 1/28/2026 | 3.40 AUD |

| 1/27/2026 | 3.40 AUD |

| 1/23/2026 | 3.40 AUD |

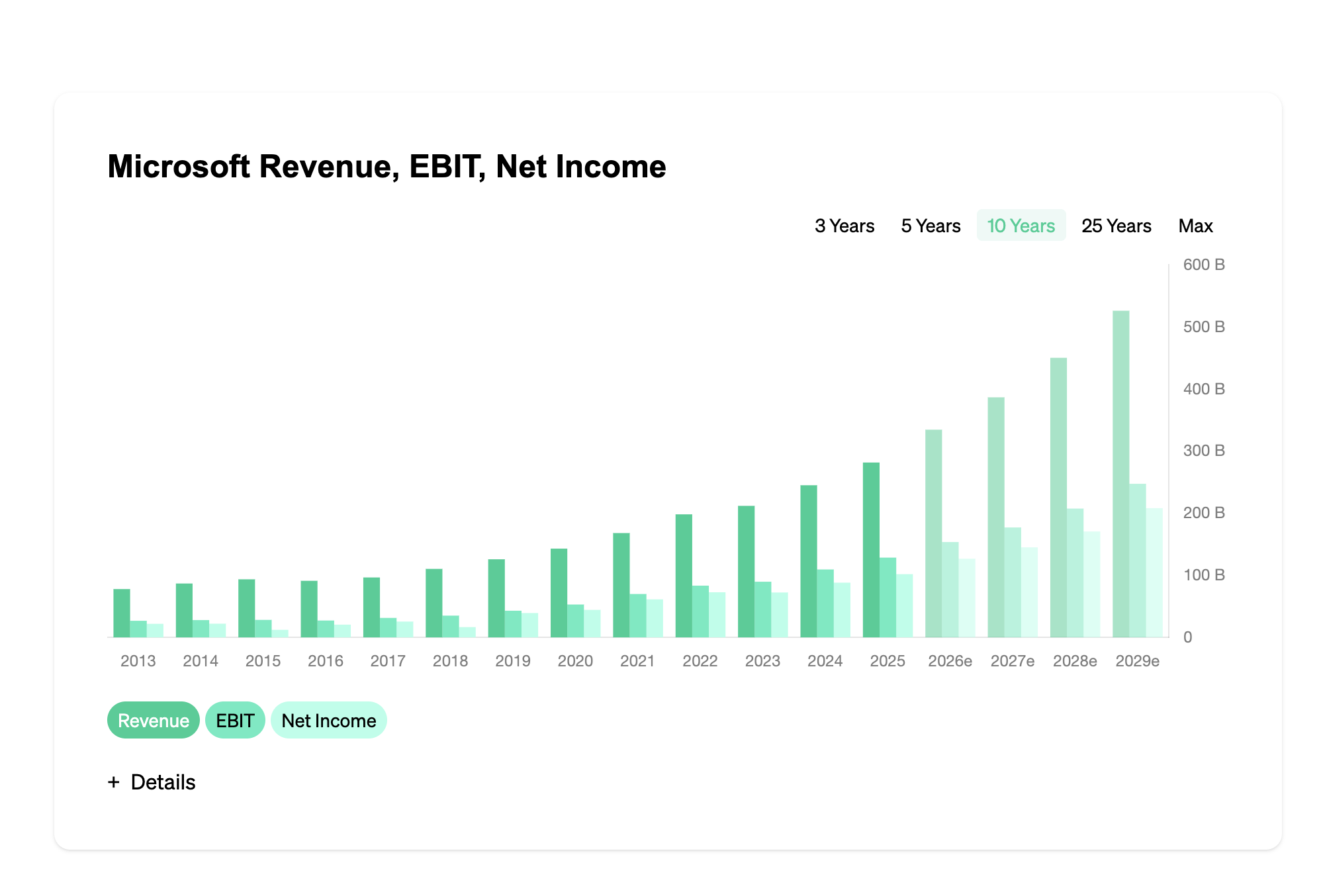

K&S Corporation Revenue, EBIT, Net Income

3 Years

5 Years

10 Years

25 Years

Max

Details

K&S Corporation Income Statement, Balance Sheet, Cash Flow Statement

| REVENUE (M AUD) |

|---|

| REVENUE GROWTH (%) |

| GROSS MARGIN (%) |

| GROSS INCOME (M AUD) |

| NET INCOME (M AUD) |

| NET INCOME GROWTH (%) |

| DIVIDEND (AUD)DIV. (AUD) |

| DIVIDEND GROWTH (%)DIV. GROWTH (%) |

| SHARES (M) |

| DOCUMENTS |

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 229 | 271 | 300 | 300 | 353 | 367 | 418 | 466 | 441 | 454 | 523 | 554 | 564 | 586 | 699 | 688 | 755 | 844 | 905 | 790 | 688 | 776 | 848 | 824 | 744 |

| – | 18.34 | 10.70 | – | 17.67 | 3.97 | 13.90 | 11.48 | -5.36 | 2.95 | 15.20 | 5.93 | 1.81 | 3.90 | 19.28 | -1.57 | 9.74 | 11.79 | 7.23 | -12.71 | -12.91 | 12.79 | 9.28 | -2.83 | -9.71 |

| 69.00 | 72.69 | 73.00 | 73.67 | 72.80 | 69.21 | 71.29 | 69.10 | 67.12 | 71.81 | 71.51 | 71.84 | 72.70 | 68.94 | 71.10 | 71.37 | 69.93 | 69.08 | 67.07 | 67.22 | 70.20 | 63.66 | 62.50 | 62.74 | 63.17 |

| 158 | 197 | 219 | 221 | 257 | 254 | 298 | 322 | 296 | 326 | 374 | 398 | 410 | 404 | 497 | 491 | 528 | 583 | 607 | 531 | 483 | 494 | 530 | 517 | 470 |

| 6 | -5 | 11 | 12 | 19 | 18 | 17 | 19 | 18 | 18 | 14 | 16 | 15 | 8 | 13 | -104 | 6 | 17 | 2 | 11 | 18 | 17 | 28 | 31 | 29 |

| – | -183.33 | -320.00 | 9.09 | 58.33 | -5.26 | -5.56 | 11.76 | -5.26 | – | -22.22 | 14.29 | -6.25 | -46.67 | 62.50 | -900.00 | -105.77 | 183.33 | -88.24 | 450.00 | 63.64 | -5.56 | 64.71 | 10.71 | -6.45 |

| - | - | - | - | - | 0.20 | 0.20 | 0.21 | 0.21 | 0.17 | 0.17 | 0.14 | 0.18 | 0.11 | 0.09 | 0.07 | 0.04 | 0.06 | 0.06 | 0.06 | 0.09 | 0.11 | 0.21 | 0.26 | 0.23 |

| – | – | – | – | – | – | – | 5.00 | – | -19.05 | – | -17.65 | 28.57 | -38.89 | -18.18 | -22.22 | -42.86 | 50.00 | – | – | 50.00 | 22.22 | 90.91 | 23.81 | -11.54 |

| 60 | 61.5 | 61.5 | 61.2 | 61.2 | 67.3 | 68.6 | 70.2 | 71 | 72.1 | 80.8 | 87.7 | 90.3 | 98.3 | 116.84 | 119.68 | 121.41 | 123.16 | 125.76 | 127.65 | 128.79 | 129.96 | 135.16 | 136.85 | 136.85 |

| – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – |

Details

Keystats

ⓘRevenue and Growth

The K&S Corporation Revenue and Revenue Growth are pivotal to understanding the company's financial health and operational efficiency. A consistent increase in revenue indicates a company’s ability to effectively market and sell its products or services, while the revenue growth percentage offers insights into the pace at which the company is expanding over the years.

Gross Margin

The Gross Margin is a crucial metric that showcases the percentage of revenue exceeding the cost of goods sold (COGS). A higher gross margin is indicative of a company’s efficiency in controlling its production costs, thereby promising potential profitability and financial stability.

EBIT and EBIT Margin

EBIT (Earnings Before Interest and Taxes) and EBIT Margin offer deep insights into a company’s profitability, excluding the impacts of interest and taxes. Investors often assess these metrics to gauge the operational efficiency and inherent profitability of a business, separate from its financial structure and tax environment.

Income and Growth

Net Income and its subsequent growth are quintessential for investors looking to understand a company’s profitability. Consistent income growth underscores a company’s ability to enhance its profitability over time, reflecting operational efficiency, strategic competitiveness, and financial health.

Shares Outstanding

Shares outstanding refer to the total number of shares a company has issued. It's instrumental in calculating key metrics like Earnings Per Share (EPS) which is pivotal for investors to evaluate a company’s profitability on a per-share basis, offering a more granular view of financial health and valuation.

Interpreting Year to Year Comparison

Comparing yearly data allows investors to identify trends, assess the company’s growth, and anticipate potential future performance. Analyzing how metrics like revenue, income, and margins change year over year can provide valuable insights into the company’s operational efficiency, competitiveness, and overall financial health.

Expectations and Predictions

Investors often juxtapose the current and past financial data with the market’s expectations. This comparison aids in assessing whether the K&S Corporation is performing as anticipated, underperforming or outperforming the market predictions, providing pivotal data for investment decisions.

K&S Corporation Stock Quarterly Figures

| REVENUE (M AUD) |

|---|

| REVENUE GROWTH (%) |

| GROSS MARGIN (%) |

| GROSS INCOME (M AUD) |

| NET INCOME (M AUD) |

| NET INCOME GROWTH (%) |

| DIVIDEND (AUD)DIV. (AUD) |

| DIVIDEND GROWTH (%)DIV. GROWTH (%) |

| SHARES (M) |

| 2000 QNaN | 2001 Q4 | 2002 Q2 | 2002 Q4 | 2003 Q2 | 2003 Q4 | 2004 Q2 | 2004 Q4 | 2005 Q2 | 2005 Q4 | 2006 Q2 | 2006 Q4 | 2007 Q2 | 2007 Q4 | 2008 Q2 | 2008 Q4 | 2009 Q2 | 2009 Q4 | 2010 Q2 | 2010 Q4 | 2011 Q2 | 2011 Q4 | 2012 Q2 | 2012 Q4 | 2013 Q2 | 2013 Q4 | 2014 Q2 | 2014 Q4 | 2015 Q2 | 2015 Q4 | 2016 Q2 | 2016 Q4 | 2017 Q2 | 2017 Q4 | 2018 Q2 | 2018 Q4 | 2019 Q2 | 2019 Q4 | 2020 Q2 | 2020 Q4 | 2021 Q2 | 2021 Q4 | 2022 Q2 | 2022 Q4 | 2023 Q1 | 2023 Q2 | 2023 Q3 | 2023 Q4 | 2024 Q2 | 2024 Q4 | 2025 Q2 | 2025 Q4 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 113 | 115 | 137 | 133 | 157 | 142 | 145 | 154 | 170 | 170 | 183 | 184 | 215 | 203 | 223 | 242 | 248 | 192 | 217 | 237 | 264 | 258 | 271 | 283 | 293 | 271 | 258 | 327 | 360 | 339 | 355 | 333 | 352 | 403 | 417 | 426 | 466 | 433 | 422 | 368 | 341 | 346 | 370 | 405 | 0 | 435 | 204 | 413 | 422 | 401 | 383 | 361 |

| – | 1.77 | 19.13 | -2.92 | 18.05 | -9.55 | 2.11 | 6.21 | 10.39 | – | 7.65 | 0.55 | 16.85 | -5.58 | 9.85 | 8.52 | 2.48 | -22.58 | 13.02 | 9.22 | 11.39 | -2.27 | 5.04 | 4.43 | 3.53 | -7.51 | -4.80 | 26.74 | 10.09 | -5.83 | 4.72 | -6.20 | 5.71 | 14.49 | 3.47 | 2.16 | 9.39 | -7.08 | -2.54 | -12.80 | -7.34 | 1.47 | 6.94 | 9.46 | – | – | -53.10 | 102.45 | 2.18 | -4.98 | -4.49 | -5.74 |

| 85.84 | 53.04 | 73.72 | 54.89 | 73.89 | 72.54 | 73.79 | 74.03 | 72.94 | 70.59 | 69.95 | 68.48 | 71.16 | 70.94 | 71.30 | 67.36 | 67.34 | 67.19 | 72.81 | 70.89 | 73.11 | 69.77 | 71.59 | 71.73 | 73.38 | 71.96 | 69.77 | 68.50 | 70.00 | 72.27 | 71.55 | 71.17 | 70.17 | 69.73 | 69.54 | 68.78 | 67.17 | 67.67 | 66.59 | 67.93 | 70.97 | 69.36 | 66.76 | 60.99 | – | 60.92 | 16.18 | 64.16 | 63.27 | 62.34 | 63.71 | 62.60 |

| 97 | 61 | 101 | 73 | 116 | 103 | 107 | 114 | 124 | 120 | 128 | 126 | 153 | 144 | 159 | 163 | 167 | 129 | 158 | 168 | 193 | 180 | 194 | 203 | 215 | 195 | 180 | 224 | 252 | 245 | 254 | 237 | 247 | 281 | 290 | 293 | 313 | 293 | 281 | 250 | 242 | 240 | 247 | 247 | 0 | 265 | 33 | 265 | 267 | 250 | 244 | 226 |

| 3 | 2 | 4 | -10 | 5 | 6 | 6 | 6 | 8 | 11 | 8 | 9 | 8 | 9 | 9 | 9 | 9 | 8 | 9 | 9 | 8 | 6 | 7 | 9 | 10 | 5 | 5 | 3 | 6 | 6 | -88 | -15 | 4 | 2 | 4 | 12 | 9 | -7 | 2 | 8 | 17 | 0 | 8 | 8 | 7 | 15 | 6 | 13 | 16 | 14 | 16 | 13 |

| – | -33.33 | 100.00 | -350.00 | -150.00 | 20.00 | – | – | 33.33 | 37.50 | -27.27 | 12.50 | -11.11 | 12.50 | – | – | – | -11.11 | 12.50 | – | -11.11 | -25.00 | 16.67 | 28.57 | 11.11 | -50.00 | – | -40.00 | 100.00 | – | -1,566.67 | -82.95 | -126.67 | -50.00 | 100.00 | 200.00 | -25.00 | -177.78 | -128.57 | 300.00 | 112.50 | – | – | – | -12.50 | 114.29 | -60.00 | 116.67 | 23.08 | -12.50 | 14.29 | -18.75 |

| - | 0.02 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 0.07 | - | 0.14 | - | - | - | - | - |

| – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – | – |

| 59.5 | 60.6 | 61.5 | 61.5 | 61.5 | 61.5 | 61.5 | 61.2 | 61.2 | 61.2 | 67.3 | 67.8 | 68.2 | 69.1 | 70.4 | 70.1 | 70.5 | 71.5 | 69.8 | 70.7 | 74.4 | 87.3 | 86.6 | 88.8 | 89.6 | 91 | 91 | 105.6 | 109.1 | 124.6 | 120.5 | 118.9 | 121.7 | 121.1 | 121.84 | 124.48 | 125.3 | 126.22 | 126.04 | 129.25 | 126.1 | 129.17 | 132.41 | 127.52 | 0 | 125.85 | 144.46 | 144.46 | 133.9 | 139.79 | 141.16 | 132.54 |

Details

Keystats

ⓘRevenue and Growth

The K&S Corporation Revenue and Revenue Growth are pivotal to understanding the company's financial health and operational efficiency. A consistent increase in revenue indicates a company’s ability to effectively market and sell its products or services, while the revenue growth percentage offers insights into the pace at which the company is expanding over the years.

Gross Margin

The Gross Margin is a crucial metric that showcases the percentage of revenue exceeding the cost of goods sold (COGS). A higher gross margin is indicative of a company’s efficiency in controlling its production costs, thereby promising potential profitability and financial stability.

EBIT and EBIT Margin

EBIT (Earnings Before Interest and Taxes) and EBIT Margin offer deep insights into a company’s profitability, excluding the impacts of interest and taxes. Investors often assess these metrics to gauge the operational efficiency and inherent profitability of a business, separate from its financial structure and tax environment.

Income and Growth

Net Income and its subsequent growth are quintessential for investors looking to understand a company’s profitability. Consistent income growth underscores a company’s ability to enhance its profitability over time, reflecting operational efficiency, strategic competitiveness, and financial health.

Shares Outstanding

Shares outstanding refer to the total number of shares a company has issued. It's instrumental in calculating key metrics like Earnings Per Share (EPS) which is pivotal for investors to evaluate a company’s profitability on a per-share basis, offering a more granular view of financial health and valuation.

Interpreting Year to Year Comparison

Comparing yearly data allows investors to identify trends, assess the company’s growth, and anticipate potential future performance. Analyzing how metrics like revenue, income, and margins change year over year can provide valuable insights into the company’s operational efficiency, competitiveness, and overall financial health.

Expectations and Predictions

Investors often juxtapose the current and past financial data with the market’s expectations. This comparison aids in assessing whether the K&S Corporation is performing as anticipated, underperforming or outperforming the market predictions, providing pivotal data for investment decisions.

K&S Corporation stock margins

3 Years

5 Years

10 Years

25 Years

Max

Details

K&S Corporation Stock Sales Revenue, EBIT, Earnings per Share

3 Years

5 Years

10 Years

25 Years

Max

Details

K&S Corporation business model

K&S Corporation SWOT Analysis

Strengths

K&S Corporation Ltd has a strong presence in the transportation industry, with a diversified range of services that includes logistics, freight, and bulk haulage.

The company has a well-established customer base and strong relationships with key clients, allowing for stable revenue streams.

K&S Corporation Ltd has a fleet of modern and well-maintained vehicles, which helps ensure efficient and reliable service to customers.

The company's experienced management team and skilled workforce contribute to its operational excellence and ability to adapt to changing market conditions.

Weaknesses

K&S Corporation Ltd faces intense competition in the transportation industry, which may put pressure on pricing and margins.

The company's heavy reliance on fuel prices can impact its profitability, as fluctuations in fuel costs can significantly affect operating expenses.

K&S Corporation Ltd's operations are primarily concentrated in Australia, which exposes the company to risks associated with a single geographic market.

Opportunities

There is potential for K&S Corporation Ltd to expand its international operations and tap into new markets, which could diversify its revenue streams and reduce dependency on the Australian market.

Rapid advancements in technology present opportunities for the company to invest in innovative solutions, such as GPS tracking and supply chain optimization systems, to enhance efficiency and customer satisfaction.

Increasing focus on sustainability and green logistics opens avenues for K&S Corporation Ltd to adopt eco-friendly practices, which can attract environmentally-conscious customers and improve brand perception.

Threats

Economic downturns and market volatility pose threats to K&S Corporation Ltd's profitability and financial stability, as they can lead to reduced demand for transportation services.

Strict regulations and compliance requirements in the transportation industry can create challenges for the company, as non-compliance may result in penalties and reputational damage.

Emerging technologies and disruptive business models in the transportation sector could pose a threat to K&S Corporation Ltd's traditional business operations if the company fails to adapt and innovate accordingly.

K&S Corporation Eulerpool Fair Value

Details

Fair Value

ⓘUnderstanding Fair Value

The fair value of a stock provides insights into whether the stock is currently undervalued or overvalued. It is calculated based on profit, revenue, or dividends and offers a comprehensive perspective of the stock’s intrinsic value.

Income-Based Fair Value

This is calculated by multiplying the earnings per share by the average P/E ratio of the selected past years for smoothing. If the fair value is higher than the current market price, it suggests that the stock is undervalued.

Example 2022

Fair Value Profit 2022 = Earnings per Share 2022 / Average P/E Ratio 2019 - 2021 (3 Years Smoothing)

Revenue-Based Fair Value

It is derived by multiplying the revenue per share by the average price-to-sales ratio of the selected past years for smoothing. An undervalued stock is identified if the fair value exceeds the ongoing market price.

Example 2022

Fair Value Revenue 2022 = Revenue per Share 2022 / Average PSR 2019 - 2021 (3 Years Smoothing)

Dividend-Based Fair Value

This value is determined by dividing the dividend per share by the average dividend yield of the selected past years for smoothing. A higher fair value than the market price indicates an undervalued stock.

Example 2022

Fair Value Dividend 2022 = Dividend per Share 2022 * Average Dividend Yield 2019 - 2021 (3 Years Smoothing)

Expectations and Forecasts

Future expectations provide potential trajectories for stock prices and aid investors in decision-making. The expected values are forecasted figures of fair value, taking into account the growth or decline trends of profit, revenue, or dividend.

Comparative Analysis

Comparing the fair value based on profit, revenue, and dividend provides a holistic overview of the stock’s financial health. Observing the annual and per-annual variations contributes to understanding the consistency and reliability of stock performance.

K&S Corporation historical P/E ratio, EBIT multiple, and P/S ratio

Details

Historical valuation

ⓘHistorical Price Earnings Ratio (P/E)

The Historical Price Earnings Ratio (P/E) is a key metric that illustrates the relationship between a K&S Corporation's share price and its earnings per share (EPS). It helps investors understand how much they are paying for a company’s earning capacity. A lower P/E ratio might indicate that the stock is undervalued, while a higher ratio can suggest overvaluation, all else being equal.

Price to Revenue Ratio (P/R)

The Price to Revenue Ratio (P/R) of K&S Corporation is calculated by dividing the current stock price by the revenue per share. This ratio offers insights into the value investors are willing to pay for each dollar of revenue generated. It is especially useful for valuing companies that are not yet profitable or have erratic earnings.

Price to EBIT Ratio (P/EBIT)

The Price to EBIT Ratio compares the K&S Corporation's market capitalization to its earnings before interest and taxes (EBIT). This ratio provides insights into a company’s profitability and operational efficiency, excluding the impacts of tax and capital structure. It is a valuable tool for comparing companies in the same industry.

Interpretation and Use

These ratios are integral in assessing a company’s valuation and profitability. Investors utilize these metrics to make informed decisions, comparing K&S Corporation’s financial performance and market valuation against historical data, industry averages, and competitors. They aid in identifying potential investment opportunities and risks, contributing to a comprehensive investment strategy.

K&S Corporation annual returns

Details

Annual Return

ⓘUnderstanding the Rendite Chart

The rendite chart provides a comprehensive view of the annual return on investment for . It is divided into two parts - stock price rendite and dividend rendite, offering insights into the overall performance and profitability of the investment.

Stock Price Rendite

This section represents the annual return due to the appreciation or depreciation of the 's stock price. Analyzing this data can help investors understand the stock’s historical performance and predict future trends.

Dividend Rendite

Dividend rendite showcases the percentage return on investment from dividends paid out by . It is a key indicator for investors looking for income generation in addition to stock price appreciation.

Making Investment Decisions

By evaluating both the stock price and dividend rendite, investors can gain insights into the total return on investment. It aids in making informed decisions, balancing between growth and income investment strategies.

K&S Corporation shares outstanding

3 Years

5 Years

10 Years

25 Years

Max

Details

K&S Corporation stock splits

K&S Corporation dividend history and estimates

3 Years

5 Years

10 Years

25 Years

Max

Details

K&S Corporation dividend payout ratio

3 Years

5 Years

10 Years

25 Years

Max

Details

K&S Corporation Earnings Estimates

| Date | EPS estimate | Revenue Estimate | Quarterly report |

|---|---|---|---|

| 2/21/2017 | 0.04AUD | 369.46 MAUD | 2017 Q2 |

| 2/25/2015 | 7.07AUD | 361.34 MAUD | 2015 Q2 |

K&S Corporation shareholders

| % | Name |

|---|---|

64.56851% | |

14.18871% | |

1.98759% | |

1.66823% | |

1.01512% | |

0.51300% | |

0.51151% | |

0.51054% | |

0.41667% | |

0.31056% |

K&S Corporation Executives and Management Board

Mr. Paul Sarant

(55)Chief Executive Officer, Managing Director, Executive Director · since 2007

Mr. Raunak Parikh

Chief Financial Officer

Mr. Christopher Bright

(52)General Counsel, Company Secretary

Mr. Anthony Johnson

Non-Executive Chairman of the Board

Mr. Legh Winser

(75)Non-Executive Director · since 1998

K&S Corporation Supply Chain

Correlation: how closely stock prices move together

| Name | 1M | 3M | 6M | 1Y | 2Y |

|---|---|---|---|---|---|

0,08 | 0,29 | 0,13 | -0,09 | — | |

0,58 | 0,23 | 0,09 | -0,53 | — | |

-0,17 | -0,30 | 0,00 | -0,58 | — | |

0,59 | 0,53 | 0,42 | -0,37 | — | |

0,04 | 0,37 | 0,09 | 0,51 | — | |

SAF-HOLLAND Supplier | -0,54 | -0,47 | -0,10 | -0,38 | — |

-0,12 | 0,26 | 0,17 | 0,45 | — | |

0,79 | 0,01 | 0,00 | -0,62 | — | |

-0,12 | 0,14 | 0,00 | 0,62 | — | |

0,50 | 0,04 | -0,06 | 0,59 | — |

K&S Corporation Research

SoonDeep-dive analyses, investment theses, and proprietary research — curated by Eulerpool.

Research reports are coming soon

We're building institutional-grade equity research for K&S Corporation and thousands of other companies.

Most common questions regarding K&S Corporation

The business model of K&S Corporation Ltd is centered around providing integrated logistics and distribution services. They offer a wide range of transportation solutions, including road freight, rail services, and warehousing. K&S Corporation aims to seamlessly connect customers with their suppliers and end-users through their extensive network and efficient operations. By leveraging their expertise in logistics management and their strong presence in the market, K&S Corporation delivers tailored, cost-effective solutions to meet their clients' needs. As a leading player in the Australian logistics industry, K&S Corporation focuses on delivering exceptional service and maximizing value for their customers.

K&S Corporation stock

K&S Corporation Peer Group

K&S Corporation Ticker

K&S Corporation FIGI

All fundamentals about K&S Corporation

Our stock analysis for K&S Corporation Revenue stock includes important financial indicators such as revenue, profit, P/E ratio, P/S ratio, EBIT, as well as information on dividends. We also assess aspects such as stocks, market capitalization, debt, equity, and liabilities of K&S Corporation Revenue. If you are looking for more detailed information on these topics, we offer comprehensive analyses on our subpages.

- K&S Corporation Revenue

- K&S Corporation Net Income

- K&S Corporation P/E

- K&S Corporation P/S

- K&S Corporation EBIT

- K&S Corporation Dividend

- K&S Corporation Directors Dealings

- K&S Corporation Stocks

- K&S Corporation Market capitalization

- K&S Corporation Debt

- K&S Corporation Liabilities

- K&S Corporation Equity

- K&S Corporation AAQS

- K&S Corporation Employees

- K&S Corporation ROE

- K&S Corporation ROA

- K&S Corporation ROCE