ASML shares rose 5.5 percent on Wednesday after the Dutch semiconductor manufacturer called DeepSeek "good news" for the industry. Nvidia, on the other hand, lost 4.8 percent in New York, despite the chip sector in Europe and Asia stabilizing following ASML's strong quarterly figures.

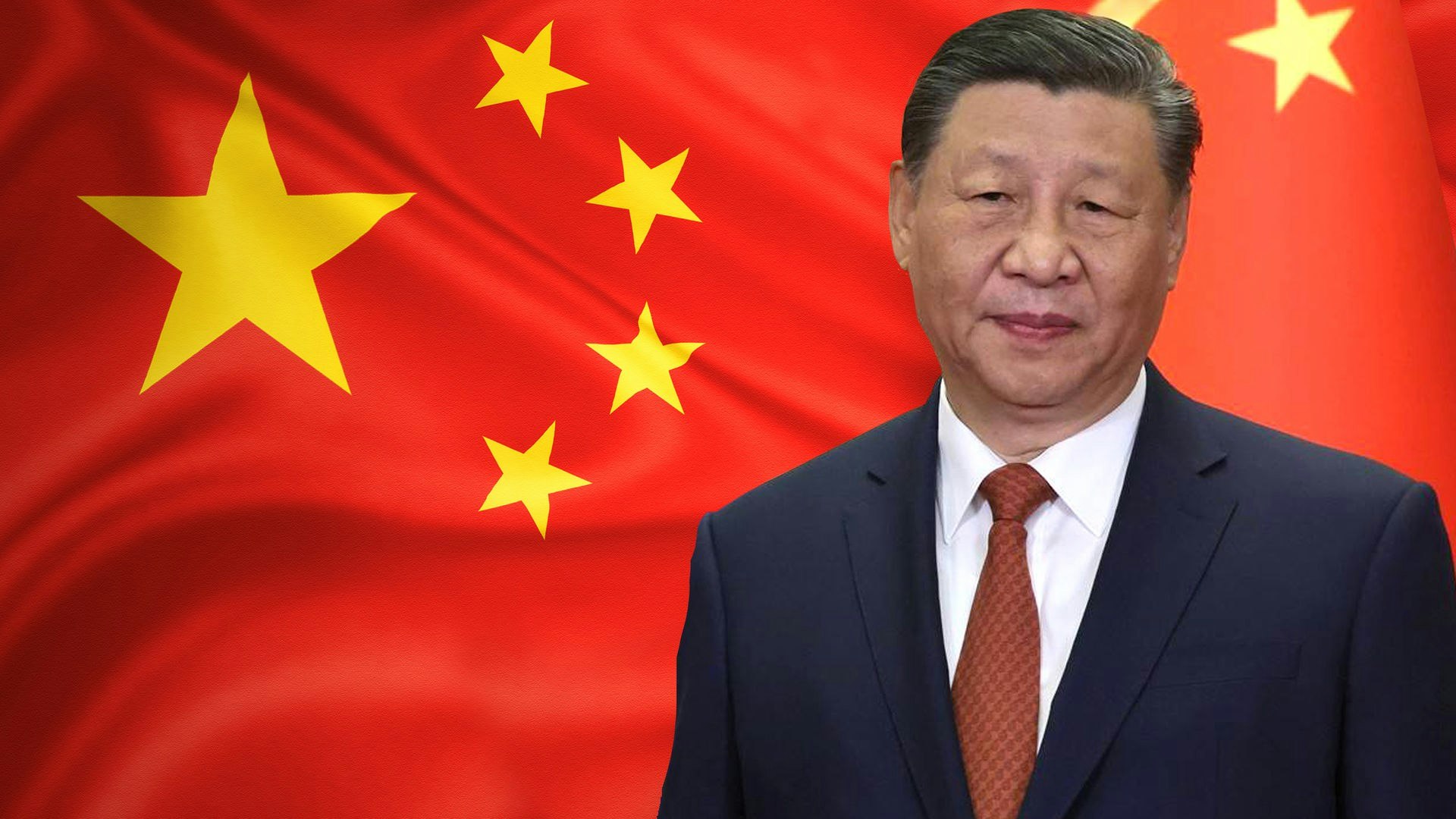

The uncertainty about the market consequences of DeepSeek continues to weigh on US technology stocks. Analysts warn that the sudden introduction of an affordable AI model by the Chinese start-up could pressure the pricing structure and market valuations of major US technology companies. Deutsche Bank expects continued volatility as market participants reassess their earnings expectations for companies along the AI value chain.

Despite the renewed strength of retail investor purchases, which invested more than $900 million in Nvidia shares this week, the S&P 500 lost 0.3 percent on Wednesday, and the Nasdaq Composite fell 0.6 percent.

ASML CEO Christophe Fouquet sees the developments surrounding DeepSeek as a positive signal: "AI requires major advances in cost and energy consumption. Anyone who can reduce these contributes to the further spread of AI – and thus also to the demand for chips.

The market responded with price gains in European semiconductor stocks. ASM rose by 3.5 percent, the European Stoxx 600 Technology Index gained 2.4 percent. Japanese chip stocks followed the upward trend: Advantest increased by 4.4 percent, Tokyo Electron by 2.3 percent, and SoftBank gained 2.4 percent.

Analysts warn, however, that Monday's shock may not have been a one-time episode. ASML CEO Fouquet anticipates further market dynamics: "The AI industry offers enormous opportunities, but also intense competition. Who will be the market leader in 2030 is not yet foreseeable today.