Markets

Nvidia surpasses Microsoft to become the most valuable US company

Chip manufacturer surpasses Microsoft for the top spot, like Cisco under John Chambers two decades ago – this time it’s different, says Chambers.

Nvidia surpassed Microsoft as the most valuable publicly traded company in the US on Tuesday, driven by high demand for its artificial intelligence chips. This technological surge evokes memories of the dot-com boom around the turn of the century.

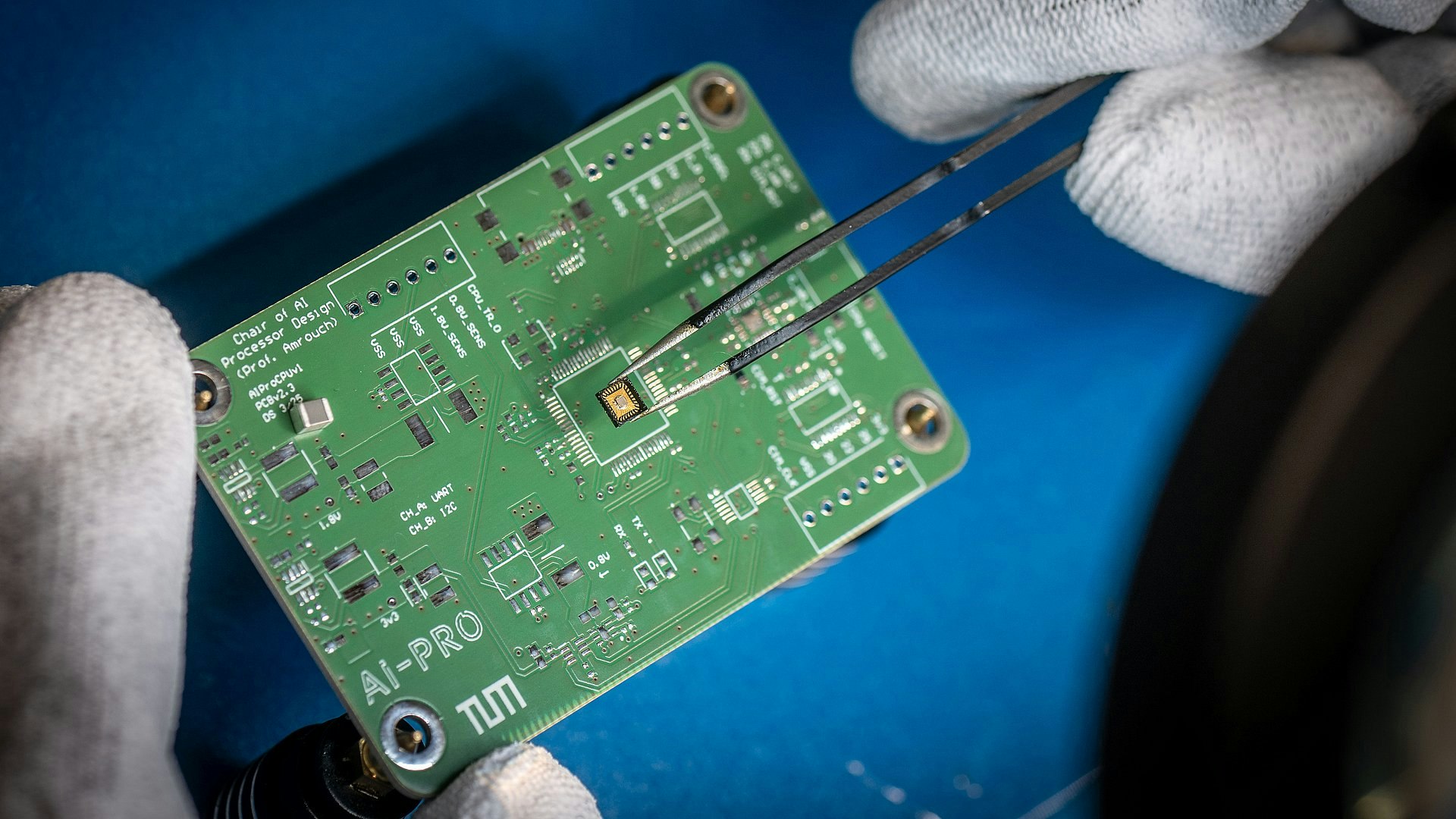

Nvidia's chips are central tools of the AI boom and essential for the development of advanced AI systems, which have captured the public imagination with their ability to generate coherent texts, images, and audio with minimal input.

The last time a major provider of computer infrastructure was the most valuable US company was in March 2000, when network equipment manufacturer Cisco held that position at the height of the dotcom boom.

John Chambers, then CEO of Cisco, sees parallels but emphasizes that the dynamics of the AI revolution are different from earlier developments such as the Internet and Cloud Computing. Chambers, now a venture capitalist, is heavily investing in AI in areas like cybersecurity.

The market opportunities are comparable to those of the internet and cloud computing combined," he said. "The speed of change, the size of the market, and the stage at which the most valuable company was reached are different.

Nvidia, a 31-year-old company, became the most valuable company in the world on Tuesday. The stock closed at $135.58, giving the chip manufacturer a valuation of $3.335 trillion, just above Microsoft at $3.317 trillion.

This is the first time since February 2019 that a company other than Microsoft or Apple holds the title of the largest company. A year ago, Nvidia was the fifth largest company by market valuation, two years ago the tenth largest. Five years ago, it was not even in the top 20.

The race among technology giants such as Microsoft, Meta, and Amazon to lead in the development and utilization of AI has led to a chip-buying spree that has driven Nvidia's revenue to unprecedented heights. In the last quarter, the company achieved a revenue of USD 26 billion, more than three times that of the same period last year.

Nvidia's stock was the best performer in the S&P 500 in 2023 and has more than tripled in the past 12 months. The company's market value reached $3 trillion this month, less than four months after crossing the $2 trillion mark.

The stock split at a ratio of 10 to 1 this month aimed to reduce the price of each share and make them more accessible to investors.

This impressive development has been praised by analysts who share CEO Jensen Huang’s view that AI is the foundation of a new industrial revolution, with the company as the primary supplier. Huang says Nvidia is building "AI factories" that take in data and produce intelligence.

Nvidia "will be the most important company for our civilization in the next ten years, as the world becomes increasingly AI-driven," said Angelo Zino, an analyst at CFRA Research. The chips developed by Nvidia are seen as the most important invention of this century.

The enormous influx of capital into AI has caused concern among investors about whether the boom can continue uninterrupted. Since the beginning of the boom, around 50 billion USD have been invested in Nvidia's chips according to estimates by Sequoia Capital in March, while generative AI startups have so far only generated 3 billion USD in revenue.

Neil Shearing, chief economist at Capital Economics, said on Monday that the enthusiasm around AI bears all the signs of an inflating bubble and is likely to contribute to US stocks continuing to rise over the next year and a half. But ultimately, it will burst, and the US market is "destined for a period of significant underperformance.

Nvidia and its CEO Huang show few signs of concern despite numerous challenges, from emerging competitors to regulators increasingly scrutinizing the company’s dominance in the AI chip market, where Nvidia holds a market share of over 80%.

Huang was in Taiwan earlier this month, where he gave a speech and announced new details about a future generation of AI chips set to be released in 2026.

With the rise of the stock, Huang has achieved a star status typically reserved for pop singers and athletes. At the company's annual conference in March, Huang delivered his keynote speech on a stage in an 11,000-person arena; in Taiwan, he was photographed signing the chest area of a woman's shirt.

Chambers said Huang operates according to a different playbook than Cisco but faces similar challenges. Nvidia has a dominant market share, similar to Cisco with its products during the Internet growth, and is defending against increasing competition. Like Nvidia, Cisco also benefited from investments before the industry became profitable.

We were definitely in the right place at the right time, and we knew it, and we took advantage of it," said Chambers.

The stock price of Cisco has not yet reached its previous high since that time.