Business

Why Owners Should Not Delete the Land Charge Prematurely

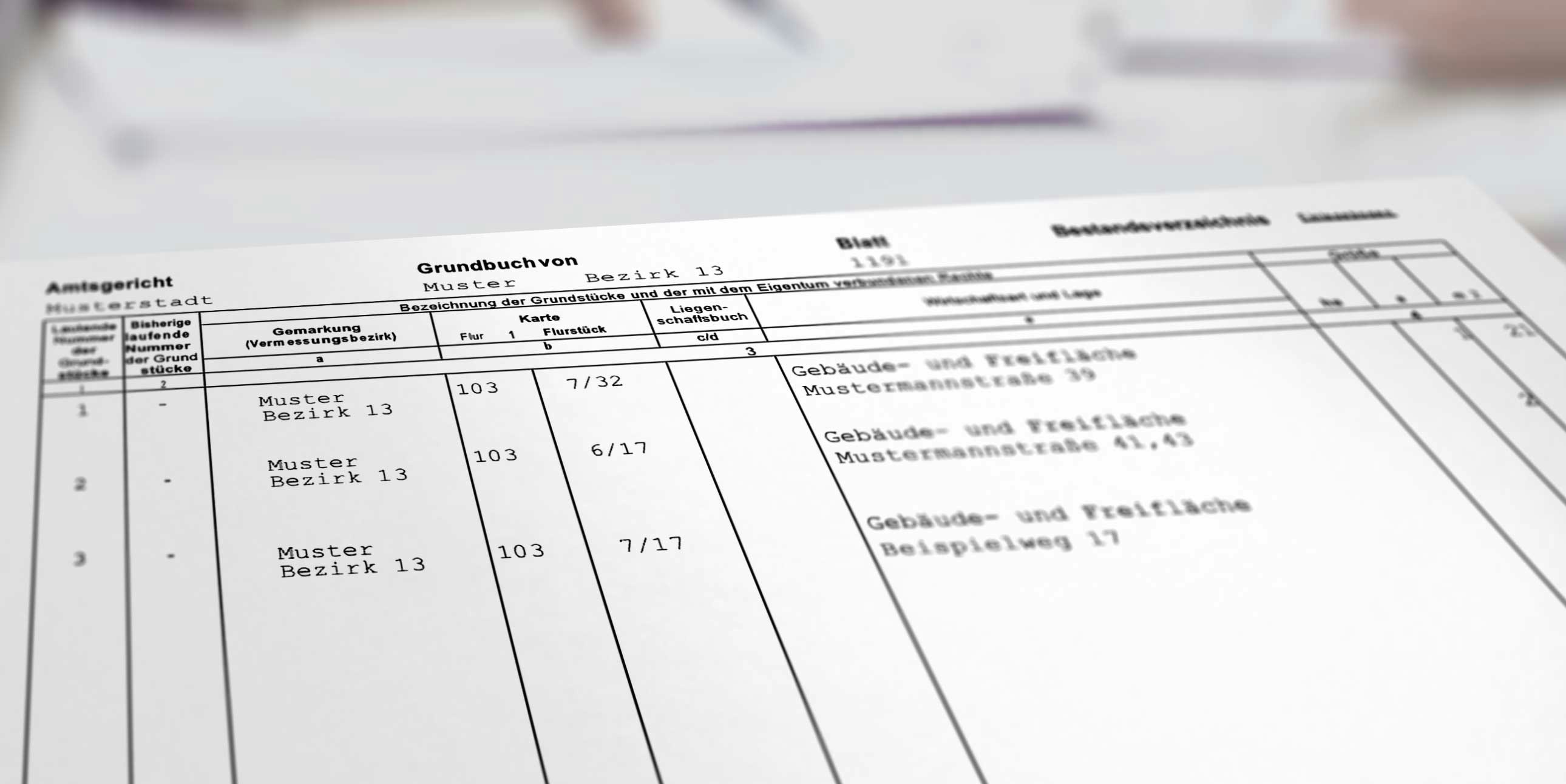

When the mortgage loan is finally paid off, many homeowners have the understandable desire to have the land charge removed from the land register. After all, it symbolically represents the old credit debt – and those who are debt-free want to see it documented. However, experts warn: This deletion is not always advisable. In many cases, it can be worthwhile to keep the entry – especially for financial reasons.

Security with Benefits

The land charge is not a penalty, but a security for the bank. It remains in full even if the loan has been fully repaid long ago. It never disappears automatically – owners must arrange for its deletion themselves. However, those who simply leave it can benefit from several advantages.

As emphasized by the Consumer Advice Center North Rhine-Westphalia, a registered land charge is "not harmful" in itself. On the contrary: It can even be useful if owners later want to borrow money again for renovation, modernization, or a photovoltaic system. The existing entry can be used as security for a new loan. The advantage: No new notary or land registry fees have to arise, which can quickly amount to several thousand euros for a new entry.

The real estate financier Dr. Klein calculates: For a new loan of 250,000 euros, the costs for a notary and land registry amount to approximately 3,500 euros - money that owners can save if they reuse their old mortgage. This also applies when purchasing a second property, as the existing mortgage can also be reactivated here.

When deletion is sensible

Despite these advantages, there are situations where deletion is inevitable. If you want to sell your property, you should have the entry removed. Buyers usually demand an unencumbered property, explains Clemens Neuschwender, Managing Director of the Notary Chamber of Palatinate. Otherwise, there is a risk that the buyer may be liable for the previous owner's debts or, in extreme cases, the property may be foreclosed.

Even with a gift or transfer within the family, such as when parents transfer their house to their children, it may be sensible to delete old land charges. If the entry remains, the new owner could use the land charge for their own loans - and if they fall into arrears, foreclosure could even threaten the parents' right of usufruct.

The Path to Deletion

Anyone who actually wants to cancel the land charge must take action. Owners must request a cancellation permit from their bank - confirmation that the loan has been fully repaid. With this certificate, go to the notary, who certifies the document and forwards the documents to the land registry office.

It is only there that the deletion is legally completed by entering a deletion note in the land register. This process usually takes a few weeks. The bank itself may not charge fees for issuing the approval, but the notary and land registry office can. For a mortgage of 200,000 euros, the total costs are around 800 euros.

Important Tip for Owners

Those who decide to keep the mortgage charge should definitely store the bank documents carefully. The documents exist only in a single copy - if the so-called mortgage charge document is lost, it becomes complicated.

In this case, a complicated summons procedure must be initiated before deletion is possible," warns notary Neuschwender. This procedure can take months, in individual cases even years. Especially in the case of inheritance or planned sale, this can lead to significant delays.