British American Tobacco (BAT) is on the verge of raising over 2 billion US dollars through the sale of a 3.5% stake in the Indian conglomerate ITC. According to a term sheet viewed by the Wall Street Journal on Wednesday, ITC shares are being offered in a price range between 384 Indian Rupees (about 4.64 US dollars) and 400.25 Indian Rupees. BAT is selling a total of 436.85 million shares, or a 3.5% stake in ITC, through a block trade. At the lower end of the price range, the sale will bring in 2.03 billion US dollars, as indicated by the term sheet.

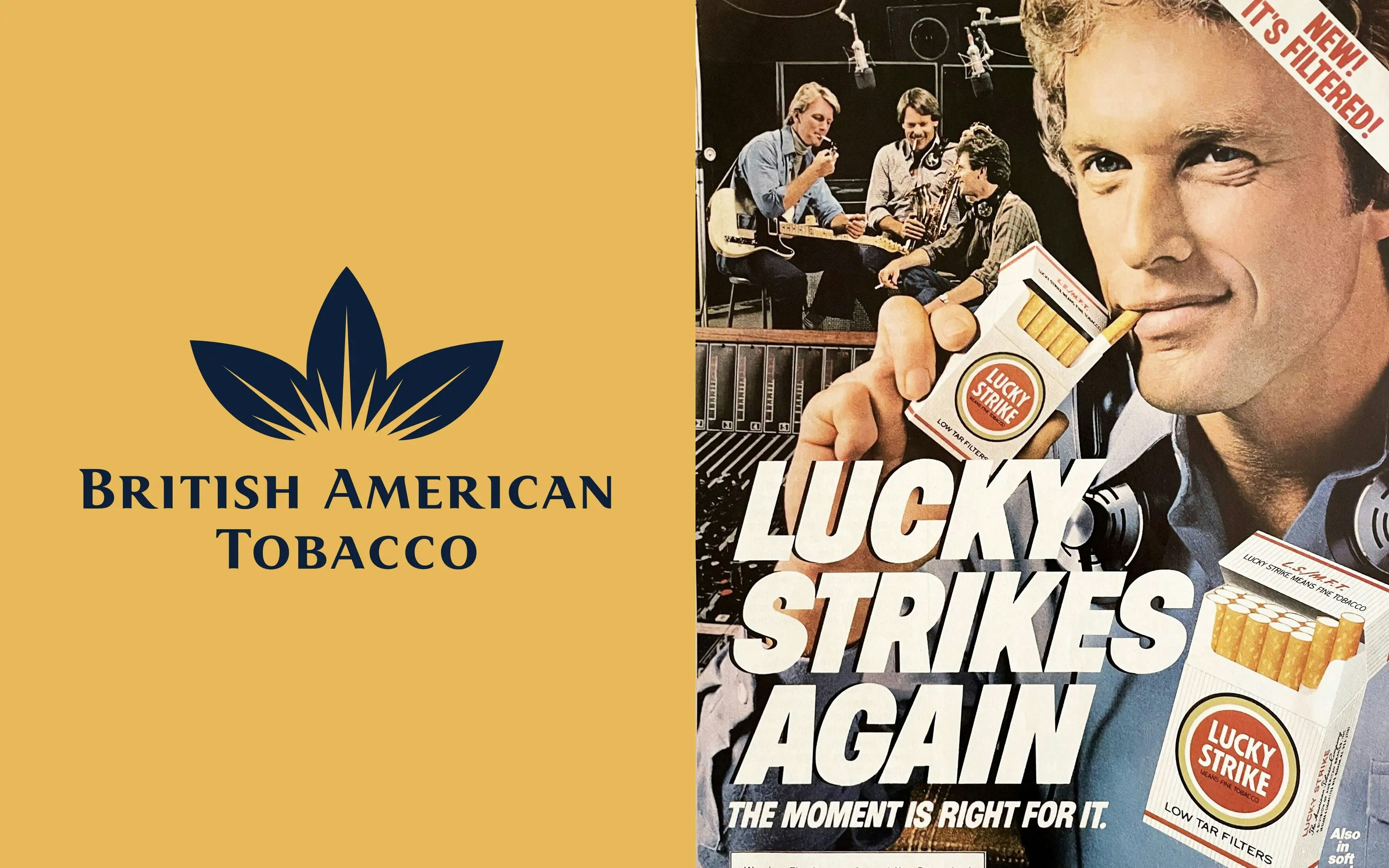

No price guidance will be provided until the shares are traded on Indian stock exchanges on March 13th, and investors should indicate their demand sensitivities over the entire price range, according to the term sheet. BAT, which is selling its shares through its Tobacco Manufacturers unit, stated that it will continue to hold a 25.5% stake in ITC after the divestment. The FTSE 100 cigarette manufacturer, whose brands include Kent, Dunhill, and Lucky Strike, intends to use the net proceeds from the block trade to repurchase its own shares over a period until December 2025, starting with almost $897 million in 2024.

ITC is one of India's largest private companies with business interests in the areas of fast-moving consumer goods, hotels, packaging, agribusiness, and IT. The term sheet showed that Bank of America Securities and Citigroup are acting as joint bookrunners for the deal.