Takeaways NEW

- Jefferies recommends Grid Dynamics and predicts higher future growth.

- Despite the decline in stock prices, positive sales developments can be observed at Grid Dynamics.

Eulerpool Markets

Supercharge your platform

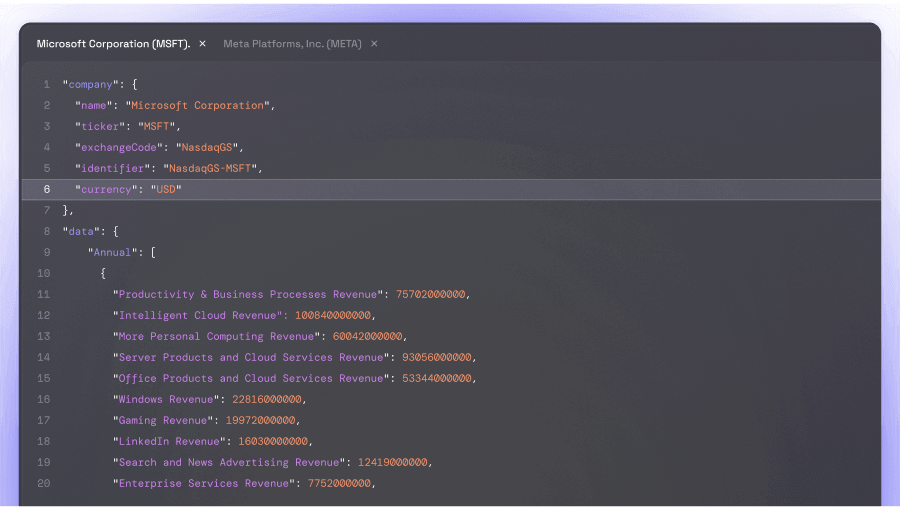

Access clean, comprehensive financial data with unmatched coverage and precision. Trusted by the world's leading financial institutions.

- Global market coverage: 10M+ equities, bonds, ETFs & more

- Real-time data streams & 100,000+ updates daily

- 50+ years of meticulously curated historical financials

- Advanced fundamentals, estimates & ESG intelligence

- Enterprise-grade APIs designed for seamless integrations